Seemingly widespread rain and a lack of genuine placement bookings on price has created the perfect storm for the sharp rise in feeder steer prices as 2024 comes to a close.

Key Points

- Little in the way of markets this week as the industry begins to wind down for the Christmas break.

- When will 2025 supplies get a roll on? Looking more likely it will be February before we begin to see these bigger numbers move, as summer trades and cattle held back reach weights.

- Price disparities between QLD markets for restocker cattle versus southern restocker prices, coupled with the excellent QLD season, indicates (if freight is manageable to get the cattle home) that QLD demand should be strong this year at the upcoming weaner sales.

The Perfect Storm?

- Feedlots (for whatever reason) seemingly were not booked as far forwards as they suggested + widespread solid falls of rain over the past month has been the perfect storm to drive this feedlot market higher.

- Feedlots are driving the market, restockers are simply reacting to higher grids / bids from feedlots and riding the market, renewed confidence (QLD in particular) following an excellent start to summer is supportive of this.

- My view into next year is that, the market remains with a soft underbelly when we get into late Feb/March 2025, once these cattle bought today or those held back begin to flow – where does the support come from if producer confidence has not materially adjusted higher?

- Particularly considering Jan/Feb 2025 is expected to be on the drier and hotter side, which could pull numbers forward quicker than anticipated.

- The first fortnight of January will be slow, as it always is, with the wet Christmas aiding this.

Supply

- A sharply higher market has encouraged producers to push cattle onto the market, both out of the paddock and into the yards.

- Movements remain solid leading into Christmas, with the market lifting producer engagement and thus supply remains solid.

- Looking ahead à it would be unsurprising to see a large week of numbers of cattle presented next week for the yards still operating as producers push cattle before Christmas for the last sales and working week of 2024.

Demand

- A continuing rise in feeder prices stands in strong contrast to comments from the market that feedlots were well covered forwards with bookings, indicating that the coverage they had either wasn’t there or they weren’t as well supplied as they suggested.

- Following the early break to the season for QLD, I expect demand to be strong at the major weaner sales in a few weeks time, although freight cost and the trust in ensuring the cattle perform will be 2 key decisive factors.

- The price disparity between current restocker prices in QLD and VIC for example indicate that if the freight is manageable, good lines of cattle at reasonable rates should be achievable.

- Considering the challenging nature of the year for southern weaner producers, good numbers of framey, less conditioned cattle should be on offer, presenting good trading opportunities for those looking.

Price

- The widening spread between restocker and feeder steers in QLD is going against the grain of other states, telling you the confidence in the QLD market at a producer level is improving, driven by the set up of a good season, encouraging them to step in and buy for a trade.

- These cattle purchased today will need to come forwards, and my thinking is a late Q1 into Q2 delivery, in line with heavier numbers of northern NSW cattle.

- The kick in Processor Cow prices can be linked back to the continuation of weak US domestic grinding beef supply from a depleted cow herd and the seasonality of softer domestic grinding beef prices.

- Australia’s competitiveness with a dollar that hit a low of 0.6338 this week and the strengthening greenback is certainly a strong contributor.

Weather

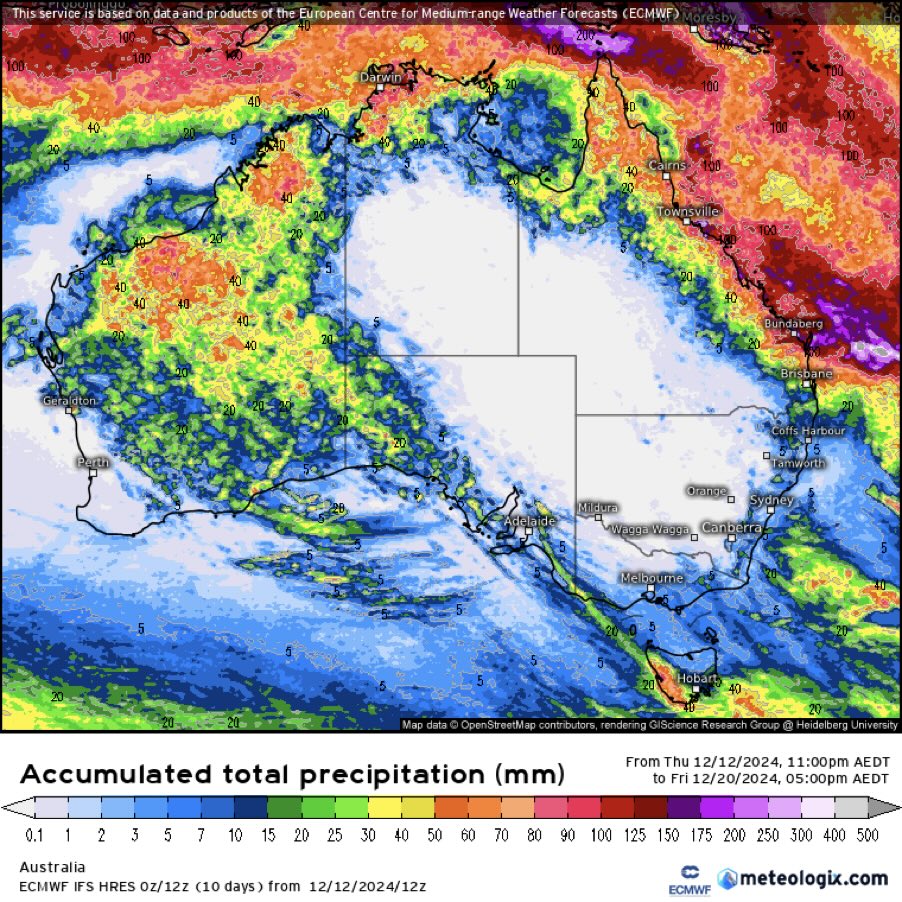

- Falls for large parts of WA, the Top end, VRD of the NT & the Gulf into next week – expect this system to move further east as the lead up to a wet Christmas begins.

- This wet Christmas is going to support a sluggish start to the new year and delay the delivery of stock a little further out, which is where we could see Jan markets start strongly because of it.

- ECMWF 7 day total precipitation forecast below:

Ripley Atkinson | Australian Livestock & Commodities Manager

M: +61 427 417 803

www.stonex.com | ripley.atkinson@stonex.com

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727)

Suite 28.01 | 264 George Street | Sydney | NSW | Australia

NASDAQ: SNEX

StoneX Disclaimer

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business.

StoneX Financial Pty Ltd (ACN 141 774 727) holds an Australian Financial Service License (AFSL: 345646) for Dealing in Securities, Exchange-Traded Derivatives Contracts, OTC Derivatives Contracts and Foreign Exchange Contracts, and is regulated by the Australian Securities and Investments Commission.

‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.