Market Morsel

Over the last month, Australia’s beef processing sector has experienced a combination of steady processing volumes and some minor over-the-hooks price adjustments driven by supply fluctuations and weather conditions. East coast plants are generally well-covered with reported cattle bookings until late-October, with slaughter volumes remaining stable at approximately 140,000 head per week since mid-June.

Average weekly east coast cattle slaughter volumes have been about 137,500 head per week during the last four weeks, which is around 15% higher than for the same period last season. Compared to the slaughter throughput volumes seen during September/October over the last five years the current east coast processing levels are nearly 25% higher.

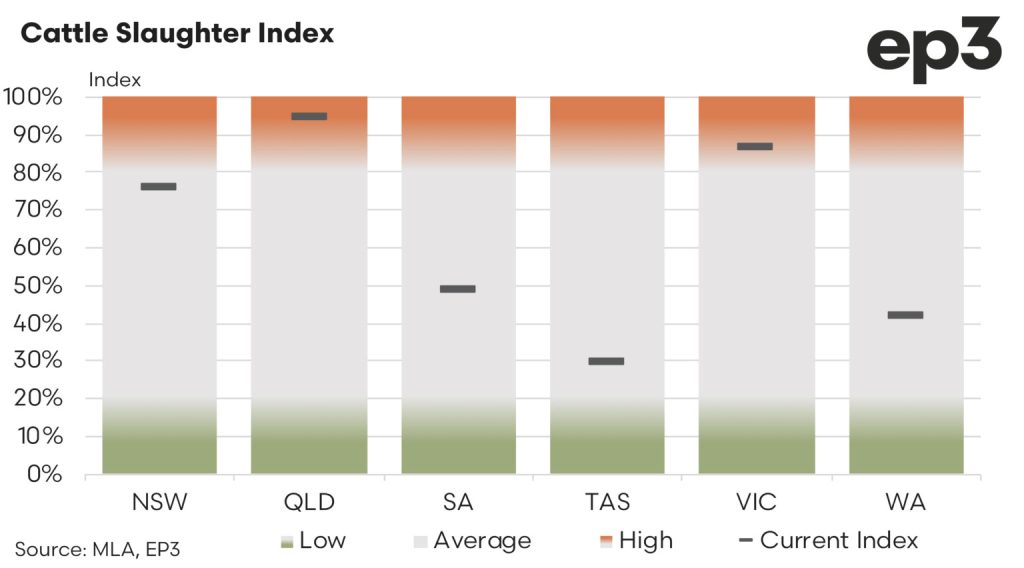

Warmer weather in Queensland has led to an increase in cattle supply, particularly from northern and western regions, contributing to processors lowering grid prices by around 10 cents per kilogram. The weekly cattle slaughter index in Queensland currently sits at 93%, which indicate that current weekly cattle processing volumes in Queensland abattoirs are higher than 93% of weekly records since the start of 2019.

The strong trend in northern cattle supply means that processing plants in Queensland are nearing capacity, especially as end-of-year plant closures approach in December. For example, several Queensland processors are expected to wrap up the 2024 season around December 19th.

In the more southern regions of Australia, cattle supply remains tight, continuing a trend that has plagued processors for months. This supply constraint is expected to ease toward November, as more local cattle become available. Anecdotal evidence from industry representatives suggest that processors from southern states like Victoria and New South Wales have been sourcing cattle from Queensland later into the year than usual.

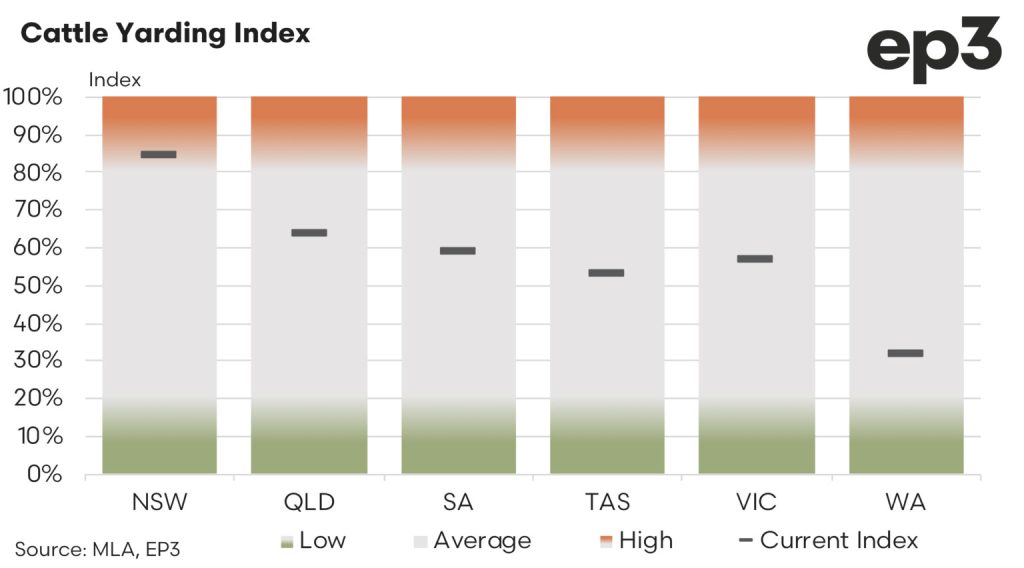

The cattle slaughter index in Victoria sits at 87% whereas the equivalent measure of Victorian cattle saleyard throughput sits at just 57%, somewhat confirming the anecdotal reports from industry that sale yard cattle supply in the south is not keeping up with processor demand, thus necessitating the northern search for available cattle.

Average weekly cattle slaughter in Victorian meat works sits at around 21,300 head presently, which is about 36% higher than the 15,700 head per week reported processed during the September/October period in 2023. Indeed, the September/October slaughter volumes seen in Victoria last year were fairly close to the five-year average volumes so the current cattle processing volumes in Victoria are about 33% higher than the usual levels seen during this time of the year since 2019.

New South Wales has a cattle slaughter index of 76% suggesting a little more space is available in NSW beef processing plants than within Victorian and Queensland abattoirs presently. Average weekly processing of cattle in NSW has been running at about 34,000 head for the last four weeks which is around 8% higher than the volumes reported processed for the same time in 2023. Furthermore, compared to the five-year average weekly cattle slaughter in NSW for the September/October period current processing volumes are nearly 19% higher.

In the west cull space is also reasonably available with an index score of 42%, indicating that weekly cattle processing volumes have been stronger than the current levels nearly 60% of the time since the start of 2019, based upon WA slaughter records for the last five years. Meanwhile South Australian and Tasmanian beef abattoirs also appear to have ample space presently with a cattle slaughter index score of 49% and 30%, respectively.

In terms of market prices, cattle prices have shown varied trends across different regions and sale types. In some areas, prices have weakened due to increased yarding levels and reduced competition among buyers.For instance, on a national basis heavy steers have seen price drops of around 15 cents per kilogram over the last month, averaging at approximately 342c/kg live weight as at mid-October.

In contrast, while some northern markets like Roma saw increased yarding, the prices for well-finished cattle remained relatively firm. However, the general trend is that both domestic and export classes have faced price pressure as supply increases and competition wanes.

The processor cow market has also been impacted, with lighter and leaner grades experiencing the sharpest decline, dropping by 30 cents per kilogram over the last month. MLA report that the national processor cow indicator has traded down from 300c/kg in mid-September to 273 c/kg live weight as at mid-October. Despite these fluctuations, prices in some southern areas such as Victoria were holding steady, albeit at slightly lower rates, with processor cows sitting at around 293c/kg lwt and heavy steers at 355c/kg lwt.