Market Morsel

Australia’s beef processing sector plays a crucial role in balancing various pressures to maintain profitability. With approximately 70% of the beef produced being exported, processors must manage the complex interplay between cattle input prices, operational costs, and revenues from beef exports and the sale of co-products. October saw several key shifts in market dynamics resulting in improved trading conditions for processors, offering relief after a brief period of tightening margins seen during the August/September period.

One of the most significant cost pressures for meat processors is the price they pay for cattle. These prices often fluctuate due to supply conditions, such as changes to cattle throughput levels as farmers adjust their stock levels and demand for beef on the domestic and international market. In October, cattle input prices eased across Australia by 5-10%, offering some cost relief for processors.

The Meat and Livestock Australia (MLA) national heavy steer indicator, a key cattle price input for processors as this type is the slaughter ready item, has staged a 10% price drop over the last six weeks from 355 c/kg to 320 c/kg. However, across the country the price declines seen for the heavy steer have been variable, with increased volumes being offered in southern markets. In Queensland, where supply levels have been a little more stable, the price easing has been much more moderate with a 5% dip noted by MLA from 330 cents to 315 cents. A stark contract to the southern markets with the Victorian heavy steer indicator down by 11% from 378 cents to 337 cents.

Supply of cows have been particularly strong over October and this has weighed on the MLA processor cow indicator, posting an 11% fall during the last six weeks on a national basis from 298 cents to 265 cents. Mirroring the heavy steer result, the processor cow indicator has seen stronger price declines in southern markets with Victorian cows off by 15% versus a 7% drop in Queensland processor cows. Since mid-September the Victorian processor cow index has demonstrated a steady decline from 323 cents to 274 cents while the price pressure in Queensland has been much more moderate, falling from 275 cents to 255 cents over the last six weeks.

In addition to cattle costs, meat processors face significant operational expenses, including labour, energy, transportation, and compliance with strict regulatory standards for food safety and export quality assurance. Labour in Australia is comparatively expensive, and with rising energy prices, especially in regional areas, processors are continuously looking for ways to optimise their operations. Despite the reduced cattle prices in October, these operational costs have remained a challenge.

On the positive side of the ledger demand has remained firm in export markets for Australian beef leading to improved export receipts over October, with key destinations like the USA, Japan, South Korea, and China driving demand for high-quality Australian beef. In October, beef export values to these key markets lifted by 2-3%, further improving the trading conditions for processors. This increase in export values allowed processors to earn more for their products, offsetting some of the operational costs and helping to absorb the impact of lower revenues from co-products.

While beef exports saw gains, the market for co-products such as hides, tallow, and bone meal experienced some downward pressure in October, with prices for offal and other co-products falling by about 2%. These co-products are essential for meat processors, providing additional revenue streams that can bolster profitability. Co-products are sold both domestically and internationally, with demand stemming from industries like cosmetics, pharmaceuticals, and animal feed. Although prices for these products declined slightly, they remain a critical part of the overall revenue mix, helping processors mitigate some of the risks associated with beef price fluctuations.

Despite the mixed performance of co-products, the combination of lower cattle input costs and rising export values ultimately improved processor trading conditions in October. The easing of cattle prices by 5-10%, coupled with a 2-3% increase in export revenues, more than offset the modest 2% decline in co-product prices.

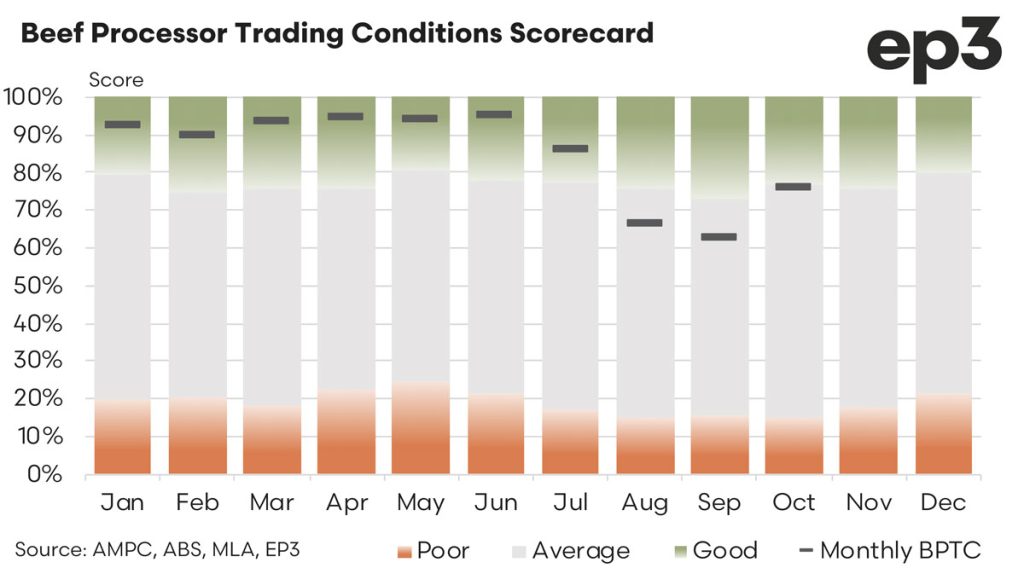

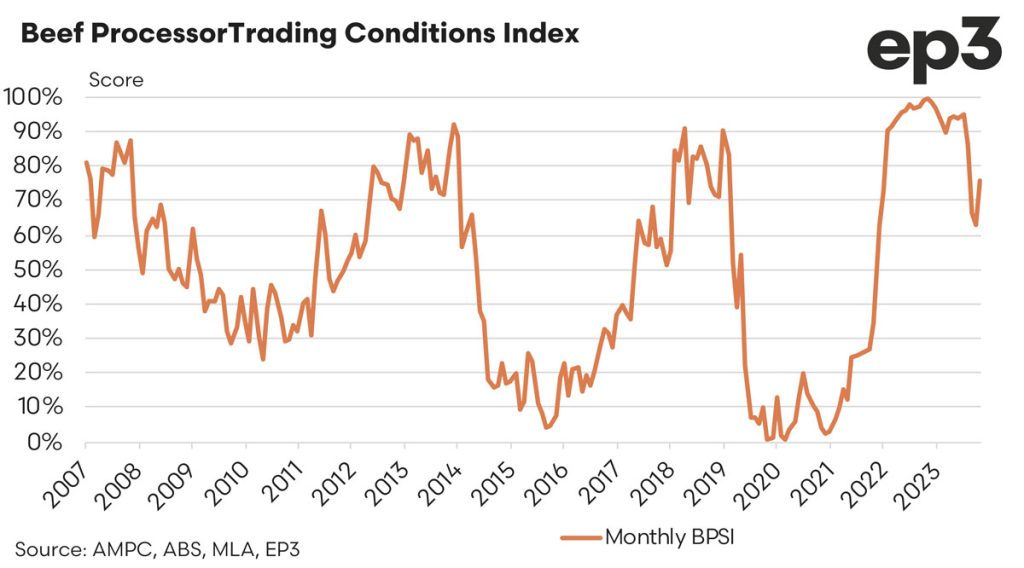

As a result, processors were able to see improved trading conditions and reduce some of the financial strain that had been building during the August/September period. After dipping to a ranking in the mid to low 60s through late winter/early spring the beef processor trading index score has lifted to 76% in October, reflecting that current trading conditions for the nation’s beef processors are better than 76% of the historic monthly records going back to 2007.