This report examines the recently released September 2024 slaughter and production figures on beef and cattle from the Australian Bureau of Statistics.

Headline Figures

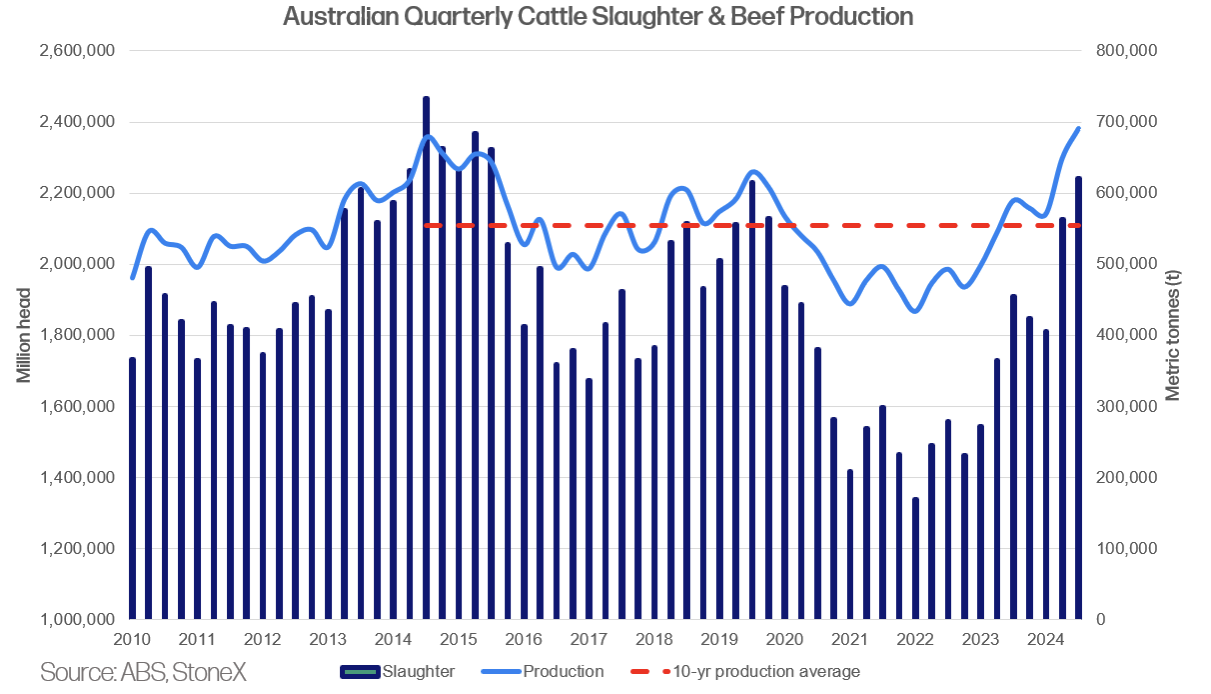

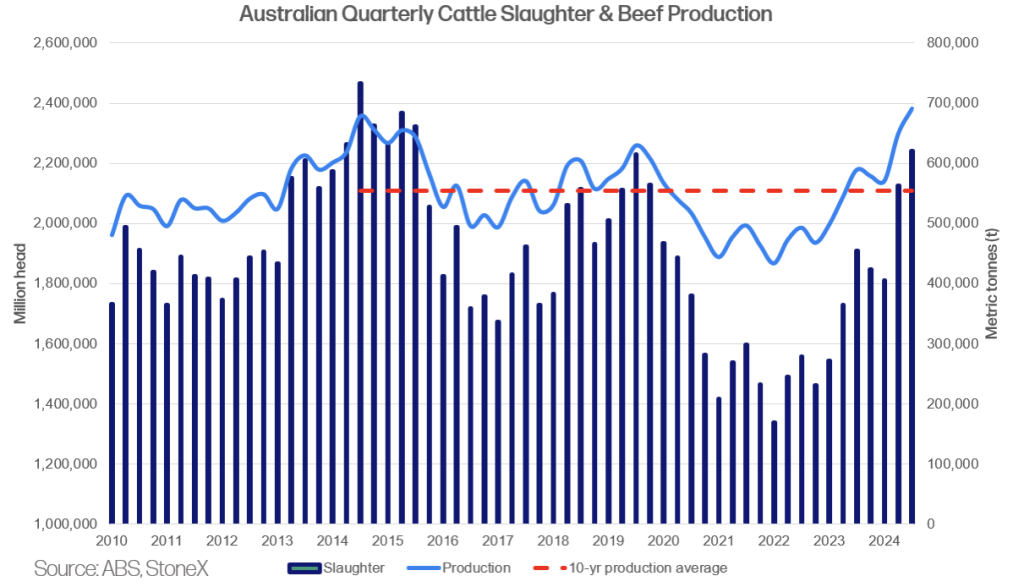

- National cattle slaughter in Q3 24’ reached it’s highest level since Q3 2015 at 2.241 million head, this is 20% or 368,000 head above the 10-year quarterly average and 29% or 500,000 head above the 5-year quarterly average.

- National beef production broke records and reached 690,000 tonnes, 12,000 tonnes higher than the previous record set in Q3 2014.

- Carcase weights lifted 4kg to 308kg/head à as mentioned yesterday, the higher grainfed turnoff has certainly contributed to this, alongside a higher volume of male kill cattle.

Slaughter

- National cattle slaughter for Q3 rose a further 5.5% or 117,800 head on Q2 and was higher than the September quarter in 2023 by 17% or 333,000 head.

- The figure that really speaks to the growth in processor throughput and how much plants have ramped up numbers in the past 12 months, it reaffirms my view that albeit at a slowing pace, slaughter will continue to grow

- 9 million head processed in 2025 and the 2014/15 quarterly figures being broken isn’t out of the question.

- The NLRS vs ABS difference remained firm at 23.7% for Q3, meaning extrapolated out, the nation in Q2 processed on average 172,000 head per week, which aligns closely with the NLRS weekly volumes reported in 2015.

- In the space of 2 years it’s an amazing turnaround in the kill numbers, 2022 calendar year kill figures were the lowest in 38 years, 2024 kill numbers will be the highest since the 19’ drought, kudos to the processors for investing in their people, plants and efficiencies, it’s clear to see the sector is handling this cattle herd at present.

- For Q3, national male kill numbers hit 1.071 million head, the highest since Q4 2015.

- This national figure is 20% or 178,000 head higher than the 5-year quarterly average and 12% or 117,000 head higher than the 10-year quarterly average.

- Both the larger turnoff of feedlot steers and also grass kills (which is a seasonal dynamic in the middle of the year) are the drivers but it also further reinforces the point that the cattle herd is much bigger than people realise and the turnoff is a reflection of that growth.

- QLD male kill numbers reached their highest level since the September quarter 2013 at 611,000 head.

- Female kill actuals rose another 4% or 40,000 head to 1.169 million head – the highest since Q4 2019 during the drought liquidation of the breeder herd (Q4 2019 the FSR was 55%)

- The FSR as expected, did soften, albeit slightly to 52.2%

Carcase Weights

- National carcase weights lifted 4kg/head QoQ but were firm year-on-year. There’s a state level element to this;

- QLD and SA carcase weights both lifted 6kg/head quarter on quarter which offset other states either remaining flat or falling.

- Why did these two states rise? The story comes from the feedlot brief last Friday and my email yesterday – the heavier contribution of grainfed kill cattle is offsetting any declines seen in grassfed carcase weights or female kills.

Production

- Production was the big highlight from this release and it really reinforces and points to the efficiency of the beef industry across two fronts, #1 cattle performance (both on grass & in feedlots) through improved genetics and management and #2 the processors increasing capacity.

- National beef production rose 42,000 tonnes or 6% QoQ from 648,000 tonnes.

- Looking at the longer term numbers, Q3 beef production was 25% or 136,000 tonnes above the 10-year quarterly average and 28% or 157,000 tonnes above the 5-year average.

- When you compare these production results to Q3 2022, when cattle slaughter was its lowest in 38 years, production is higher by 197,000 tonnes or 40%

- What those figures tell you is the leaps and bounds the beef sector is making in cattle performance (carcase weights) and how this is translating into the more product we’re producing.

- It also strongly explains with why we’ve seen record monthly beef export volumes twice within the September quarter.

- When you think about slaughter, even though it’s not at record highs (yet), but we’re producing the most been we ever have, that is a great story to share about the sector’s efficiency.

Ripley Atkinson | Australian Livestock & Commodities Manager

M: +61 427 417 803

www.stonex.com | ripley.atkinson@stonex.com

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727)

Suite 28.01 | 264 George Street | Sydney | NSW | Australia

NASDAQ: SNEX

StoneX Disclaimer

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business.

StoneX Financial Pty Ltd (ACN 141 774 727) holds an Australian Financial Service License (AFSL: 345646) for Dealing in Securities, Exchange-Traded Derivatives Contracts, OTC Derivatives Contracts and Foreign Exchange Contracts, and is regulated by the Australian Securities and Investments Commission.

‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.