Beef Processor Trading Conditions – November 2024 update

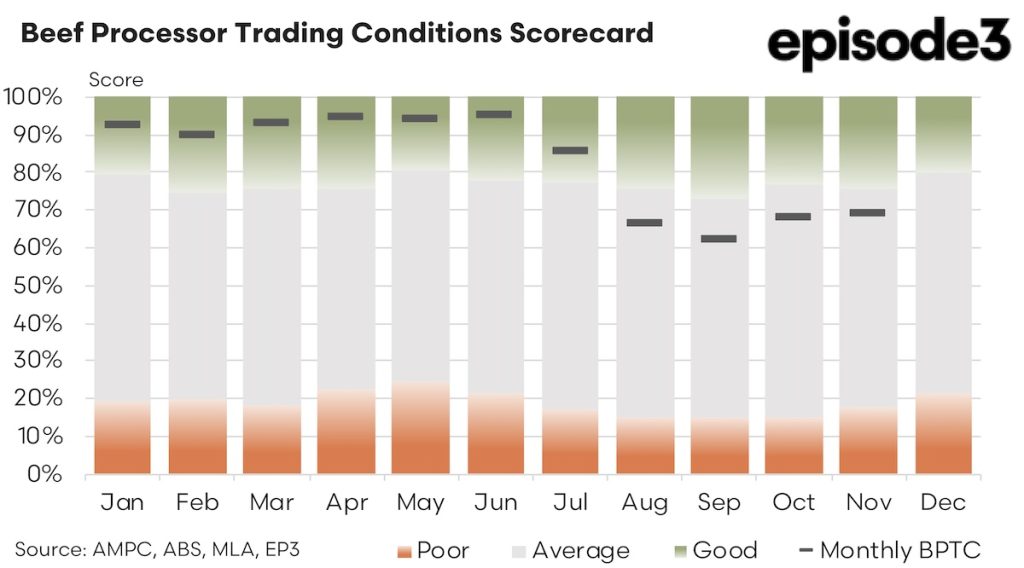

November brought a mixed bag of results for Australia’s beef processing sector, with trading conditions improving slightly. The trading index lifted from 68% in October to 69% in November, reflecting a marginal gain for processors navigating a complex mix of cost pressures, export market volatility, and rising operational expenses. While some elements worked in the sector’s favour, others limited profitability, highlighting the challenges processors face in balancing global and domestic dynamics.

Cattle prices, a major expense for processors, eased by 1% over the month, providing limited relief. These price adjustments, although modest, align with broader trends in the Australian cattle market as supply and demand dynamics continue to shift. Farmers have adjusted throughput levels, contributing to this slight reduction, but the decline was insufficient to significantly counteract rising operational costs and export market fluctuations.

This easing followed a sharper price drop observed earlier in the year, yet it failed to generate the same financial cushion. For many processors, maintaining profitability depends on more substantial reductions in cattle prices. Even so, this easing helped soften the blow of rising costs elsewhere in the production chain.

Exports remain a critical component of the beef processing sector, contributing around 70% of total revenues. November saw divergent trends across key export destinations. In the USA, prices held steady, reflecting consistent demand. Meanwhile, Japan and South Korea offered brighter spots, with beef export values rising 5% and 2%, respectively This uplift highlighted a continued appetite for Australian beef in these regions, buoying earnings.

However, this optimism was dampened by a steep 10% drop in export values to China, one of Australia’s largest markets for beef export products and offal. The sharp decline effectively wiped out much of the gains achieved in Japan and South Korea. This mixed export performance underscores the sector’s vulnerability to shifts in global demand and market-specific challenges, which can significantly influence overall earnings.

On the domestic front, retail beef prices rose by 1% over the last quarter, offering limited relief to processors. While this increase signals some resilience in local demand, it failed to offset the broader challenges posed by export market volatility. Domestic price gains, though encouraging, remain relatively minor compared to the financial impact of international trends, given the sector’s heavy reliance on exports.

Revenue from co-products, which is an essential component of processor profitability, declined significantly in November. Offal products experienced a substantial 10% price drop, while rendered products and pharmaceutical co-products fell by 2% each. Co-products, often sold domestically and internationally, contribute to revenue streams that help stabilise processor margins. Their downturn further constrained earnings, leaving processors with fewer buffers to absorb operational cost increases.

Co-products have historically served as a counterbalance to fluctuations in cattle and beef prices. The declines seen in November highlight the challenges faced in maintaining this balance, as demand for items like hides, tallow, and offal products can be influenced by broader economic conditions and industry-specific trends.

Adding to these challenges, operational costs continued to climb. General processing costs increased by 1% over the quarter, driven by higher expenses for labour, energy, and compliance with stringent regulatory standards. The food manufacturing sector as a whole experienced a 3% rise in utilities and wages, further tightening margins for processors.

Energy costs, particularly in regional processing hubs, remain a significant burden. Rising utility expenses have compounded pressures on processors, forcing many to focus on efficiency and cost optimisation to remain competitive. These operational pressures are unlikely to ease in the near term, presenting a persistent challenge for the sector.

Despite the headwinds, the beef processor trading index edged up to 69% in November, marking a slight improvement over October. This increase, though marginal, reflects the sector’s resilience and ability to navigate a challenging landscape. The modest uplift underscores the importance of managing multiple variables effectively, from input costs to export performance and operational efficiency.

While processors likely welcomed the small gain seen during November, the path forward remains fraught with challenges. The sector’s ability to sustain or improve trading conditions will depend on a combination of factors, including stabilising export values, mitigating rising costs, and finding innovative ways to enhance profitability.

Looking ahead, Australia’s beef processors face an uncertain horizon. Beef export markets, particularly China and the USA, remain an area of interest as the looming Trump presidency and sabre rattling seen recently regarding trade and protectionist tariff regime being proposed may cause some uncertainty and volatility to the sector.