“Learn from yesterday, live for today, hope for tomorrow.” – Albert Einstein

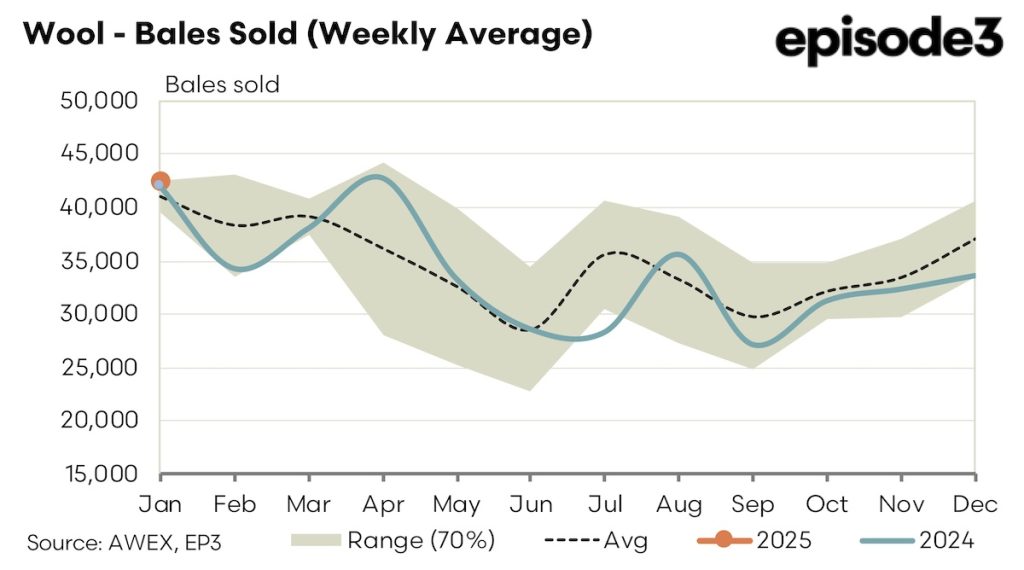

The anticipated kick in the spot auction market came to pass with all qualities rising between 1.5 and 3.5% this week. The increase can be attributed to a combination of the pent-up demand following the Christmas recess and a strengthening USD. The USD improved 2.2% against the AUD.

The spot rally bought out good interest in the forwards as exporters looked to partially hedge sales put on over the last three weeks. The 19.0-micron contract traded out to the spring at 1505 (25 cents over Wednesdays closing spot). 20 tons traded from May through to August, September maturities.

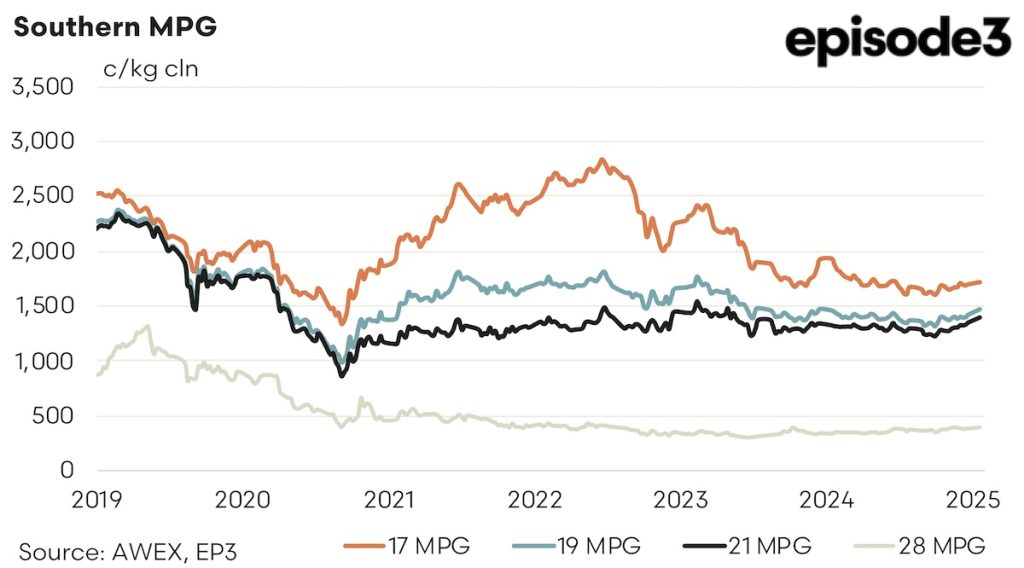

Current bidding is at spot levels and approaching resistance levels that have held for the last 18 months (19.0 1500 and 21.0 1400). Now is the time for growers to reassess their hedge levels for the balance of this season and into 2025/26.

The strength of the USD is helping maintain these higher levels but history tells us the underlying supply/demand balance will dictate the longer term direction. At this point in time demand continues to be problematic with macro-economics and global uncertainty causing headwinds. Supply will remain tight and continue to drive the range bound trading of the last 18 months.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.