Cattle numbers continuing to build has pressured pricing this week, whilst 2024 cattle slaughter looks set to reach highest level since 2019 drought year

Key Points

- 2024 adult cattle slaughter estimated to be 8.25 million head, the highest since 2019 drought induced liquidation year.

- Saleyard cattle supply last year was the highest since 2015 and rose 30% or 720,000 head compared to 2023 yardings.

- Strong retraction in feeder grids and prices out of the saleyards for feeder and restocker cattle this week with larger numbers pressuring prices.

2024 Slaughter & Production Estimates

- Now that weekly slaughter figures have been reported by the NLRS, 2024 actual cattle slaughter can be calculated.

- I have applied the yearly rolling average of the difference between NLRS weekly slaughter and ABS actuals at 23.1%, although, my 2024 slaughter and production estimates may underestimate the actual outcomes, in Q3 24’ difference was 23.7%, the adjustments are minor though.

- Based on my estimates, 2024 cattle slaughter reached 8.25 million head, the highest since the 2019 drought induced liquidation year.

- This figure, if realized, would be a rise of 1.24 million head or 18% increase compared to 23’ volumes.

- Compared to 10-year averages, 2024 slaughter was higher by 850,000 head or 11%, and against 5-year averages, higher by 1.4 million head or 20%

- Justifying how significant the growth has been in processor capacity and subsequently, throughput in a very short space of time.

- A slightly lower Q4 production figure between 634k – 651,000 tonnes based on my estimates should result in 2024 beef production should come in line with the 2014 record of 2.53 million tonnes à this is under the assumption Q4 carcase weights average 308kg/head. If carcase weights are heavier, we’ll see the 2014 record broken.

- As mentioned a few weeks ago, assuming the above does occur, Australian beef production will be in line with the 2014 record, despite 965,000 head less of cattle processed. Carcase weights higher by 33kg/head compared to 14’ are the driver.

Supply

- We’re beginning to see the 2024 cattle which were held back, begin to move, as well as sellers realizing the strong market and wishing to offload some numbers, some may also be seasonally pressured, as is the case in far western QLD.

- The balance between supply and demand is why the market has softened, with more numbers moving and offered generally, this is putting the supply and demand situation into equilibrium for the time being, following a red hot first fortnight of 25’.

- 2024 saleyard supply was the highest since 2015, compared to the 10-year average, was higher by 13% or 365,000 head and Year-on-year saleyard supply rose by 30% or 720,000 head.

- Looking ahead à with a dry start into early February forecast from central NSW into central QLD, I believe the numbers will continue to roll, pressuring prices across the market in W1 Feb at least, cows should hold a little firmer.

Demand

- Supply and demand situation is delicately poised looking forwards, a large tropical low of the north coast of QLD may interrupt impact this with rainfall and if it doesn’t extend into southern areas of QLD and temperatures remain hot, we could see further downside.

- I mentioned last week that a retraction in feeder prices may have pushed restockers into doing the sums, seemingly this looks to be happening, with the sharpest reduction in prices coming from the restocker end of the market this week.

- Remembering though, that the restocker market is the most volatile. It moves around a lot more than feeder and finished prices.

- I’m still not convinced producer confidence has experienced any major uptick and am yet to see evidence as to why it has, QLD in isolation the mood is a bit more upbeat, but if the market is supposed to get these sky high cattle prices people keep talking about, we’re going to need to see a material change in confidence and a very sharp reduction in supply in 2025. Neither of which I see happening this year – which is why I’m more bearish on pricing in 2025 than most others.

Price

- Swaps are trading inverse into the middle of the year, meaning forward markets are softer than today’s cash price, which is telling… the market believes a softening in price is coming due to higher supplies.

- With the saleyard market typically leading grids, this week we saw a softening of feeder grids as they follow the saleyard markets down.

- Cow market holding up quite well considering the supply, US interest for CL trim the driver here.

- On cows, expect to see the southern processors push north quite early in 2025 chasing supply, both out of the yards and the paddock, I see some good resilience in the cow market as exporters compete for a limited supply to capture US market opportunity.

Weather

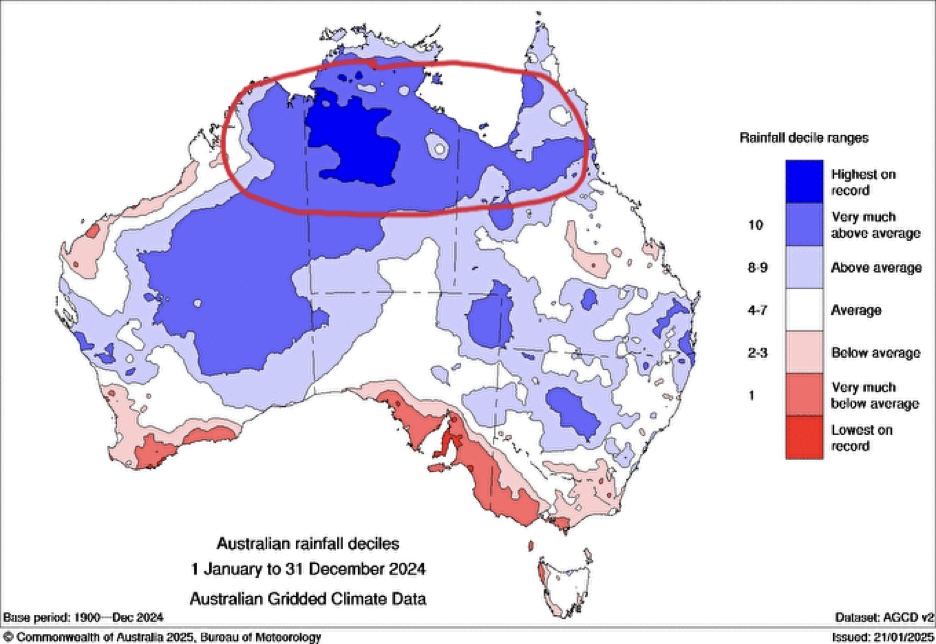

- February will bring the latest onset of the wet season on record, pretty interesting statistic. Remember calves conceived over this wet will come to market in mid – late 2026, ensuring high supply of cattle well into 2026.

- Vast numbers of Australia’s cow herd is located in the area circled in red above, further reinforcing my belief of continued herd growth, as a result of this, expect the availability of live export cattle this year to be strong.

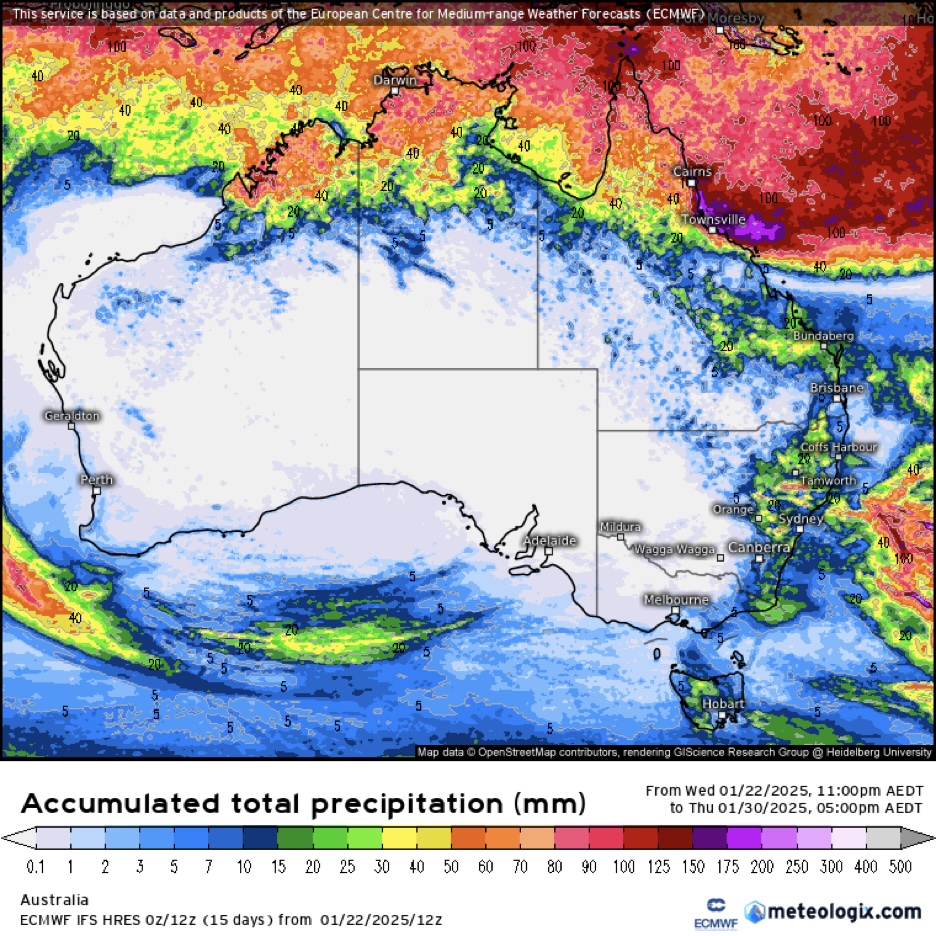

- 7 day accumulated precipitation forecast from ECMWF below – similar areas to the 2024 decile rainfall map circled above are forecast for good falls in the next week.

- Scattered falls in central QLD and parts of northern NSW may assist in stemming some supply next week, although with declining feed bases and hot weather supply is expected to remain strong.

Ripley Atkinson | Australian Livestock & Commodities Manager

M: +61 427 417 803

www.stonex.com | ripley.atkinson@stonex.com

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727)

Suite 28.01 | 264 George Street | Sydney | NSW | Australia

NASDAQ: SNEX

StoneX Disclaimer

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business.

StoneX Financial Pty Ltd (ACN 141 774 727) holds an Australian Financial Service License (AFSL: 345646) for Dealing in Securities, Exchange-Traded Derivatives Contracts, OTC Derivatives Contracts and Foreign Exchange Contracts, and is regulated by the Australian Securities and Investments Commission.

‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.