Higher supplies of cattle has slowed and reversed pricing movements this week, although QLD demand for cattle back to the paddock remains very strong to kick off the new year.

Key Points

- US 150 day feeder steers on an OTH fed price are currently valued in the cash markets at A$11.34/kg cwt, whilst the feedlots themselves experience margin squeezes due to high feeder and corn prices pushing into the futures markets.

- Feedlots emptying pens to meet processor demand to get plants back up and running post-Christmas is supporting higher feedlot interest in the market to replace cattle.

- The 60c/kg lwt spread between QLD and NSW restocker steer prices, strongly indicates the QLD interest to capitalize on excellent seasonal and grass growing conditions following a wet end to 2024.

US Updates – Feedlot margins squeezed as corn and feeder cattle futures rise.

- Brazil has already filled 85% of the “Other Country” quota into the US and its only mid-January, once that quota is hit, which is 65,000 tonnes, 26.4% tariff is applied to US imports for countries from Brazil.

- Last week I noted US live (fed steers) cattle prices in cash markets had cracked A$7/kg cwt, re doing that calculation I made a mistake, that figure actually represents a fed steer (150 days on feed) in liveweight value at A$7.20/kg (based on spot AUD), and in carcase weight value that translates to A$11.34/kg cwt.

- On a 430kg carcase weight fed steer, that equals to A$4,900/carcase.

- Below is a margin calculator the US StoneX Meat & Livestock team produce in their Daily market update, in the red circle area, you can see feedlot margins on 150 day cattle bought in Jan-25 for a May-25 turnout are in the 5th percentile on a 10-year monthly basis for profitability… corn prices have hit 12 month highs and the CME Feeder Futures contract hitting record highs is significantly impacting margins for feed lotters.

- On current futures markets coupled with corn prices, feedlot margins continue to remain extremely tight to September 2025 for US feeders.

Figure 1. StoneX US Meats & Livestock Team – 150 day Feeder Cattle Crush price spread.

Supply

- A combination of a return to work and a strong market at the open for 2025 has pushed plenty of cattle forwards, add in some drying weather this week (particularly for QLD) and broader paddock cattle supply also picked up.

- In the yards, when you remove store sales, the fat markets had their largest week since mid february 2024, I put that down to producers seeing the strong market and wanting to cash in.

- Looking further out, I’m still of the opinion these northern NSW/ QLD feeder cattle held back in late 2024 will turn up within the next month or so in droves, cattle doing 1kg/day plus must be sold at some stage before blowing out the top of grids.

- Cow supply should remain somewhat constrained for the time being, the south should have pushed most of its cows out of the system post weaning for the autumn calves and the spring calvers are yet to be weaned. We won’t see the northern cows until April/May.

Demand

- On the topic of cows, I can see the supply and demand balance remaining out of kilter for cows as the US trim market pushes demand in Australia for the next 2-3 years as the US attempts to rebuild its numbers.

- This week’s markets reflected more of a balance between supply and demand which is why saleyard prices generally softened, grids for feedlots yet to follow.

- Another factor to consider in this demand situation, particularly for feeders, is processors (that do both grass and grainfed) will demand higher numbers of grainfed cattle to get plants back up and running post Christmas as producers return from holidays, which empties feedlots and in turn pushes feedlot demand higher to replace these cattle exiting the system.

- It’s not surprising to see the market start quiet hot like this before softening up as supply and demand begin to match one another, more cattle will naturally pressure upside, whilst feeder grids not following the restocker market higher week-on-week might have spooked a few producer buyers into doing the sums.

Price

- A$4.10 – $4.15/kg lwt seems to be where the feedlots are pulling up on the 100-day feeders this week, following sharp lifts in December, a rain event could move that higher and conversely if conditions persist in a drier state, the question can be posed, have we found the top of this market? Time will tell. I lean on we’re nearing the top without much more upside with the big IF a widespread major rain event doesn’t transpire. At least until larger supplies start moving.

- Feeders and heavy cattle softened under higher supply this week in the yards, although you would call the direct bids firm.

- There’s a 60c/kg lwt or 15% spread emerging in early sales between NSW and QLD restocker steer prices – indicating the strength of demand for cattle to trade in the state following the exceptional start to the summer wet in 2024 and how that’s translating to plentiful availability of grass and optimal weight gain conditions for cattle.

Weather

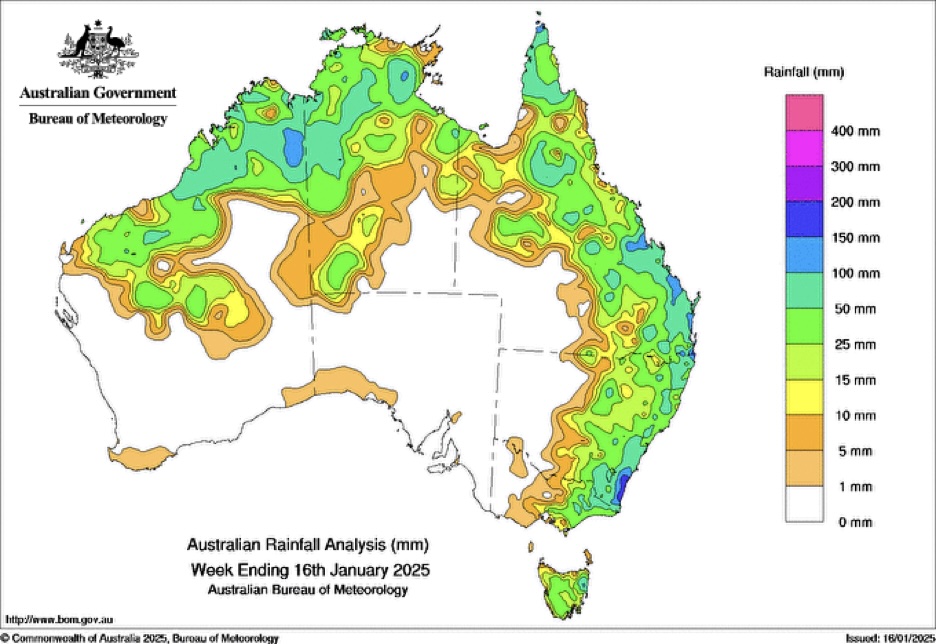

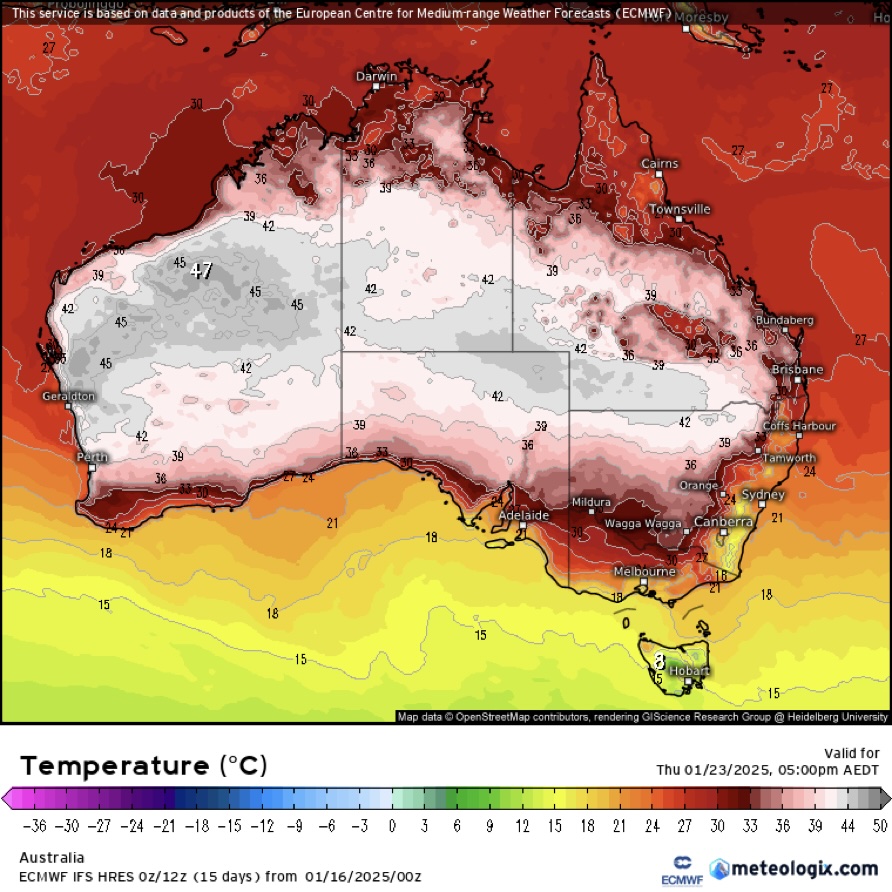

- The solid falls that continue to occur across QLD is going to keep upward pressure on restocker prices in the state for the foreseeable future, or at least until heat or dry conditions force a change.

- Good falls across the Kimberley, NT and Gulf regions will support another strong start to the calendar year for the big northern breeding herds.

- Widespread heat forecast for the next week across large parts of the country, with little in the way of rain, contained to the coastal areas of northern NSW and the northern tropics.

- If this drying trend continues, coupled with bouts of hot weather, I expect cattle supply may sharpen up faster than previously expected.

Ripley Atkinson | Australian Livestock & Commodities Manager

M: +61 427 417 803

www.stonex.com | ripley.atkinson@stonex.com

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727)

Suite 28.01 | 264 George Street | Sydney | NSW | Australia

NASDAQ: SNEX

StoneX Disclaimer

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business.

StoneX Financial Pty Ltd (ACN 141 774 727) holds an Australian Financial Service License (AFSL: 345646) for Dealing in Securities, Exchange-Traded Derivatives Contracts, OTC Derivatives Contracts and Foreign Exchange Contracts, and is regulated by the Australian Securities and Investments Commission.

‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.