Market Morsel

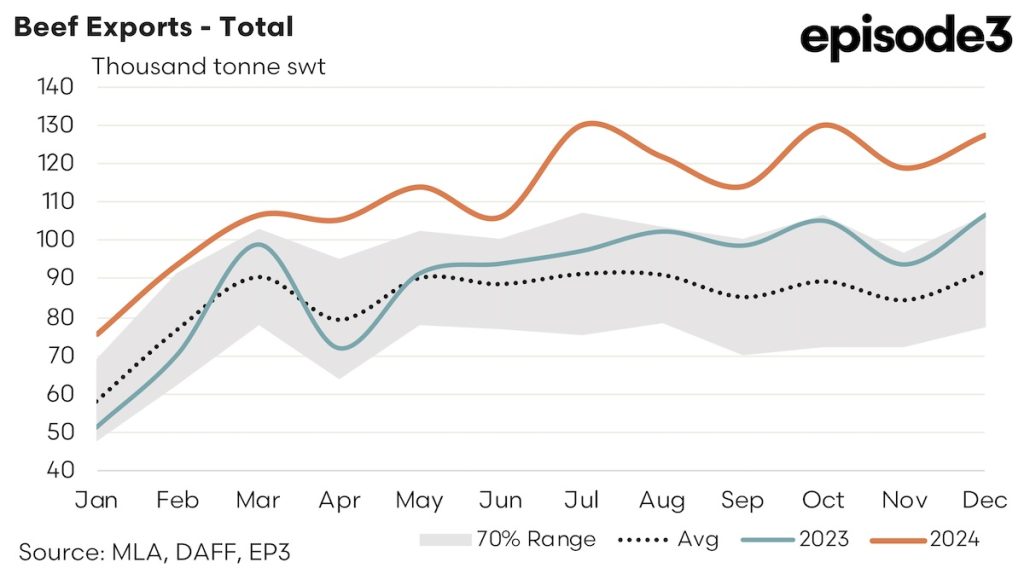

There was a promising end to 2024 for Australian beef exports with a strong finish to Chinese demand noted. Three of the four top trade destinations finished the year with export flows running well above average seasonal levels too, setting up for a solid 2025 for Aussie beef exports. There was a total of 376,318 tonnes of beef product shipped out of Australia during Q4, 2024, which is a 29% increase on the volumes exported during Q3, 2024.

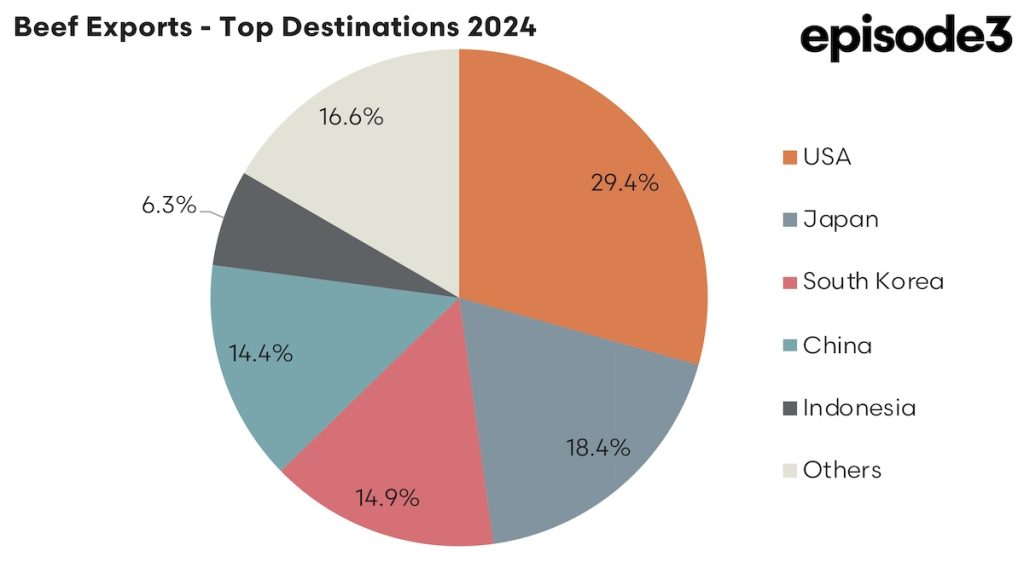

Compared to Q4, 2023 the flows for the final quarter of 2024 were equally impressive running 23% above the levels set this time last year and a huge 41% above the five-year average seasonal levels. In terms of top trade destinations the USA dominated the 2024 season with 29.4% of the beef export trade from Australia. Japan was the only of the four top trade destinations to remain below their average seasonal pattern in Q4, 2024 yet still managed to hold onto the second top trade destination for market share with 18.4% of the trade. South Korea and China battled it out for 3rd and 4th spot on 14.9% and 14.4% of the trade flows, respectively.

A summary of the top trade locations, in order of top market share for 2024, is as follows:

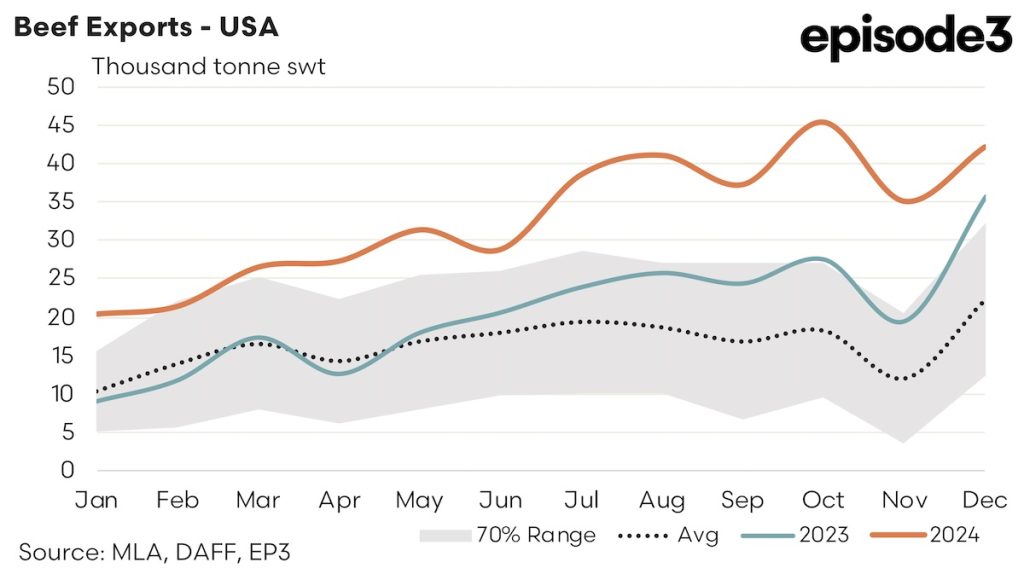

USA – The final quarter of 2024 was the strongest on record to the USA, mirroring the solid levels seen back in the 2014/15 seasons with 122,467 tonnes shipped for Q4, 2024. This was a 5% increase on the beef trade volumes seen during Q3, 2024. The 2024 season was an exceptionally strong year for the Aussie beef trade to the USA with the final quarter of 2024 posting trade volumes that were 48% above the levels seen in Q4 last year and a huge 113% higher than the Q4 average trade flows, based on the last five years of the trade. Tight supplies expected in the USA in 2025 suggest that demand will remain strong for Aussie beef this year too.

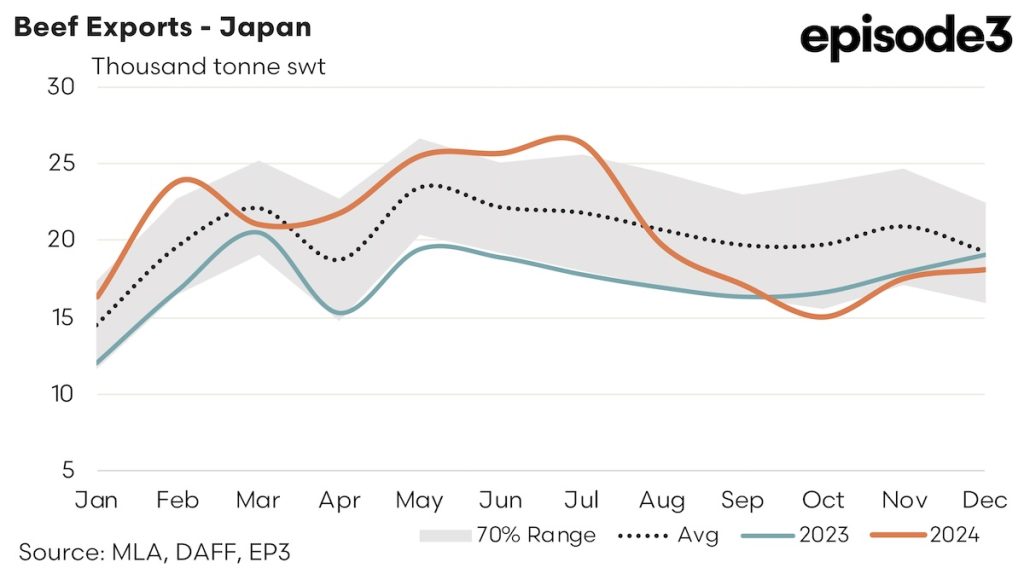

Japan – After a strong first half of 2024 Japanese demand remained subdued for Aussie beef over the second half of the year. Q4, 2024 saw 50,618 tonnes of beef shipped from Australia to Japan, a 20% drop from the levels shipped during Q3, 2024. Compared to the final quarter of 2023 the trade volumes sent in Q4 of this year were 5% lower and sat 15% below the five-year average trend for Q4 to Japan.

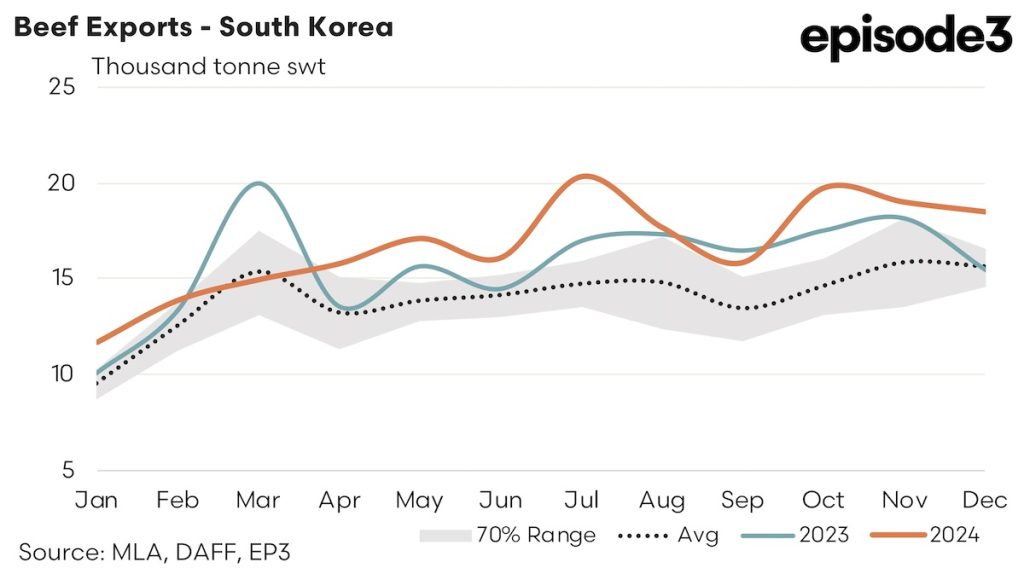

South Korea – Quarterly beef export volume to South Korea made a new record of 57,230 tonnes for the final quarter of 2024, beating the previous record which was only set in Q3, 2024 by 6%. Compared to the five-year average volumes seen exported during Q4 the current flows to South Korea are running 24% stronger and sit 12% higher than the trade flows seen in Q4, 2023.

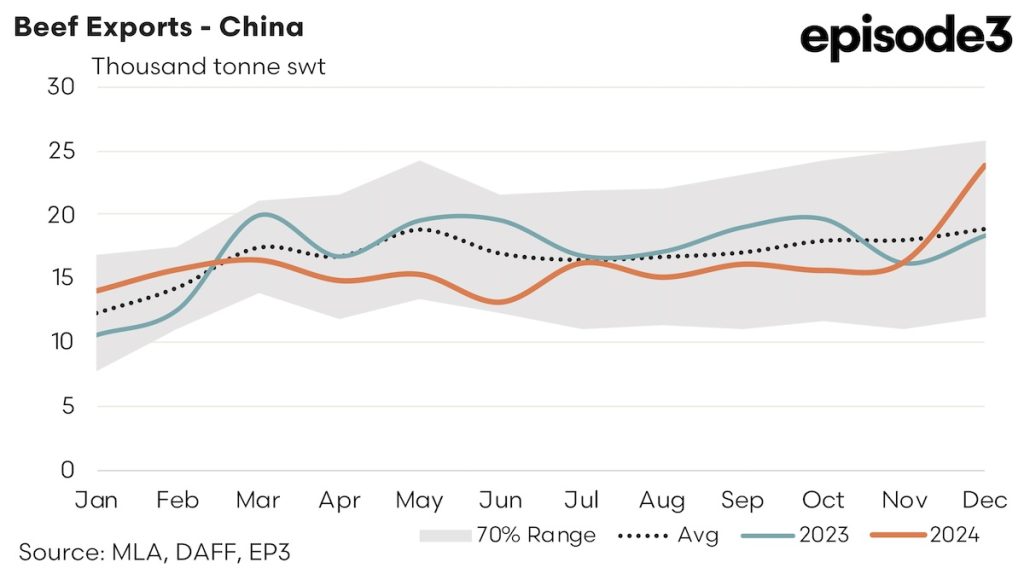

China – There was an impressive gain in beef export volumes from Australia to China seen during December and it helped push the Q4, 2024 volumes to 55,875 tonnes – the highest quarterly beef trade volumes from Australia to China have been since Q2, 2023. Compared to Q4, 2023 the current flows to China are 3% stronger and are 2% above the Q4 average levels, based on the last five years of the trade.