Key Points

- Restocker heifer to steer discounts continue to indicate strong trading opportunities, something some agents & producers have capitalised heavily on with trading strategies in 2024.

- As the Angus to Flatback premium narrows, people should be selling the swap into mid 2025 where the premium will then have widened and maximum value can be made on their Angus sold at that time.

- Softer producer demand due to higher costs of doing business, the 2023 market hangover and cash flow issues limit the amount of upside to cattle prices to the end of 2024. Markets need producers to drive them.

Restocker steer to Heifer premium not looking like ending anytime soon

- I haven’t looked at this price relationship in over 12 months and thought it was worth a revisit. The restocker steer to heifer premium based on actual values is currently operating in the 90th percentile & from Q2 2022 has operated in the 80th percentile or higher for every quarter since.

- Why is this important? It shows the immense trading opportunity in heifers over the past 2 and a half years relative to historical performance & the strong discounts they continue to operate at in both actual & % terms compared to steers.

- We know there’s been a number of agents and producers who have recognised and capitalised on this trading opportunity in 2024.

- The price relationship mimics the herd cycle, whereby spreads tighten during rebuilds and widen during droughts – the chart below shows this.

- But we haven’t seen this lack of demand for heifers in the market for such a sustained period since 2010 at least. Why? Because breeding herd numbers are at decade highs and the necessity or demand from producers for females is weak.

- I am of the belief this discount will continue for some time, there’ll be pockets or markets where this spread narrows, think SA/VIC when seasons allow numbers to lift but more broadly, heifer prices should stay softer due to weaker demand from the producer market for heifers overall and thus will continue to present good trading opportunities into 2025.

Supply

- As expected, the short week saw numbers tighten coupled with some falls and storms throughout major supply areas, namely NW NSW, SE QLD and eastern VIC this week.

- Having a lot of conversations around cattle not kicking on with weight gains (location dependent), and I think there’s two reasons for this:

- #1 – these cattle born as spring calves in 23’ had a tough start to life, some started life with very little feed which will mean their growth was stunted and they’ll aways struggle with performance.

- #2 – conversations I’m having with cropping mates, they’re telling me soil temperatures are still too cold to consider sorghum plantings, which would mean soil temps on grazing country wouldn’t be any warmer – this will affect pasture growth coupled with the lack of hotter weather we’ve had consecutively so far this spring. Marred by cooler changes & rain.

- To week ending 04 October, YTD NLRS cattle slaughter is averaging 15% or 17,000 head higher than YTD 2023 weekly averages – add the ABS difference of +18.5% and slaughter in 2024 on a weekly basis is averaging around 152,000 head.

- Looking ahead – rain is forecast for large areas of the eastern seaboard & parts of WA next week, this should cause further supply hiccups in the market next week. I think we’ll see bigger numbers of cattle start moving from the end of this month into November.

Demand

- Heifers aside, the continuation of softening Angus grids is seeing the spread tighten over flatbacks and this will continue most likely into early 2025, hearing similar spreads tightening with F1’s (Angus/Wagyu) occurring also which is expected.

- The net affect of this, means users should be selling the swap today into the middle of 2025 if they’re selling Angus then. The spread will naturally widen as Angus supply gets short and price they get paid for their cattle rises relative to the flatback price for that month

- Early January 25’ demand for Feeders could be delayed, with Easter and 2 consecutive short working weeks occuring 100 days after January 10 2025 à this will be something to keep an eye on as to how feedlots manage inductions over this early new year period.

- I wrote an article for AuctionsPlus earlier this week on my thoughts about current supply and how a lack of producer confidence would limit market upside to the end of 2024 – to read the article click the link below:

Price

- Having 2 major sales like Tamworth & Wagga not operate on Monday, as referenced last week, the indicators are a little out of whack, their calculations are based off 7 day rolling averages meaning missing 2 major sales affects that calculation & the price output.

- Paddock prices & market reports read softer again with the major focus point being producer confidence & lack of demand and issues around cashflow and cost of doing business. Something this email has referenced as a red flag for sometime.

- Without the producer driving the market, the upside remains capped and the above factors are the fundamental reasons why this is the case.

- Although the markets have continued to soften, they’re a damn sight between than this time 12 months ago… anywhere from $1.20 to $1.40/kg lwt higher which is without doubt good news.

- Looking ahead à rain may assist underlying demand next week, solid supply should keep a lid on major upside to price as we move through the second half of spring.

Weather

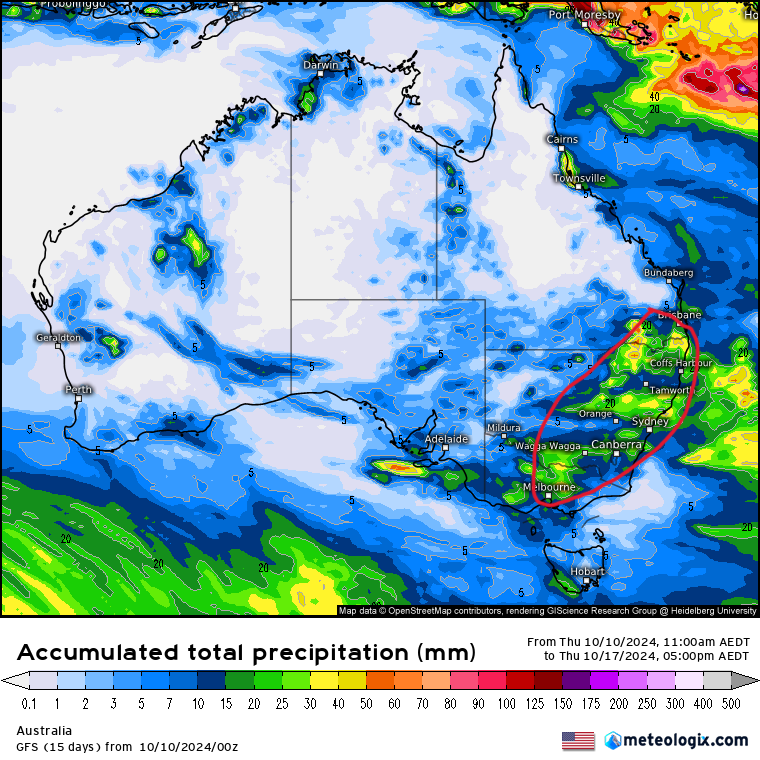

- Large areas of the eastern seaboard are forecast for good rain next week with adjoining lows from the north & south of central australia converging to bring falls across wide areas.

- GFS 7 Day Forecast below – models should ramp up the forecast closer to mid next week.

Ripley Atkinson | Australian Livestock & Commodities Manager

M: +61 427 417 803

www.stonex.com | ripley.atkinson@stonex.com

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727)

Suite 28.01 | 264 George Street | Sydney | NSW | Australia

NASDAQ: SNEX

StoneX Disclaimer

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business.

StoneX Financial Pty Ltd (ACN 141 774 727) holds an Australian Financial Service License (AFSL: 345646) for Dealing in Securities, Exchange-Traded Derivatives Contracts, OTC Derivatives Contracts and Foreign Exchange Contracts, and is regulated by the Australian Securities and Investments Commission.

‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.