Market Morsel

Australian sheep meat abattoirs have prioritised mutton processing over lamb since winter, as strong export demand and favourable margins for mutton coincided with delayed spring lamb supply. This trend reflects both robust mutton export markets and the slower arrival of new season lambs, allowing processors to capitalise on mutton volumes to meet global demand.

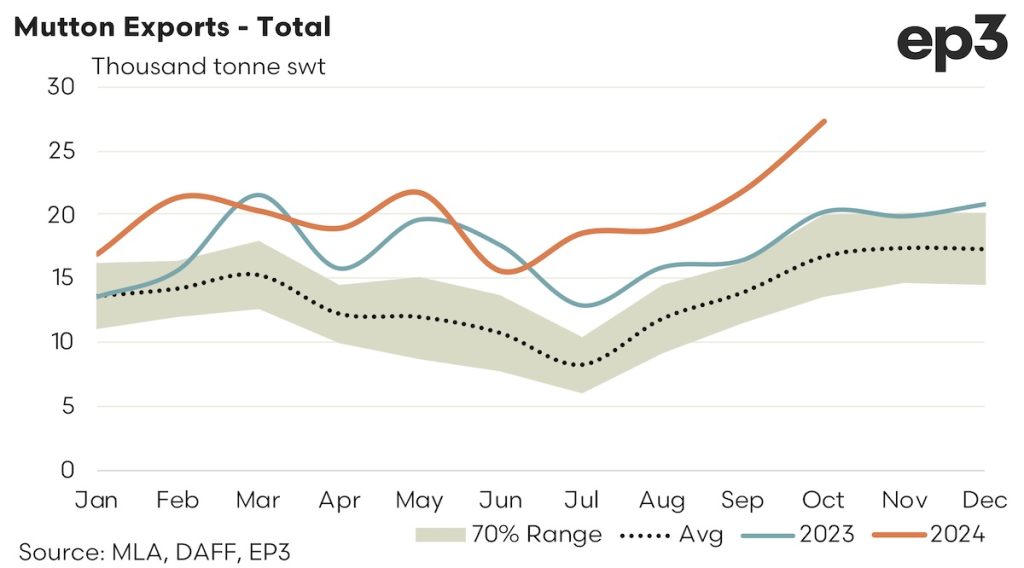

October 2024 saw mutton exports soar to 27,217 tonnes, the highest October volume on record and the second-highest monthly total ever. This marked a 25% increase from September and a 35% rise over October 2023 levels, with China and Malaysia driving the surge. China imported 14,613 tonnes, setting a new monthly record and surpassing previous highs by 17%. Malaysia followed with an impressive 169% jump to 3,164 tonnes, the second-highest volume on record for the market.

In contrast, lamb exports remained more subdued. Total lamb exports for October reached 26,673 tonnes, down nearly 3% from September and marking the second weakest month of the year. Although volumes were 5% above the five-year average, they were 13% lower than October 2023. Key markets like the USA and China showed only marginal or declining demand, with China’s lamb imports 34% below the five-year average due to economic challenges and weak consumer sentiment.

A notable exception in the lamb trade was the United Arab Emirates (UAE), which saw a 43% month-on-month increase in lamb imports, this growth was despite a new free trade agreement that is yet to come into full force but bodes well for 2025 when the UAE free trade deals comes into effect. While lamb exports to other markets remained relatively stable, the strength and momentum seen in mutton exports far outpaced the lamb trade, underscoring the distinct processing dynamics between these two segments of Australia’s sheep meat industry currently.

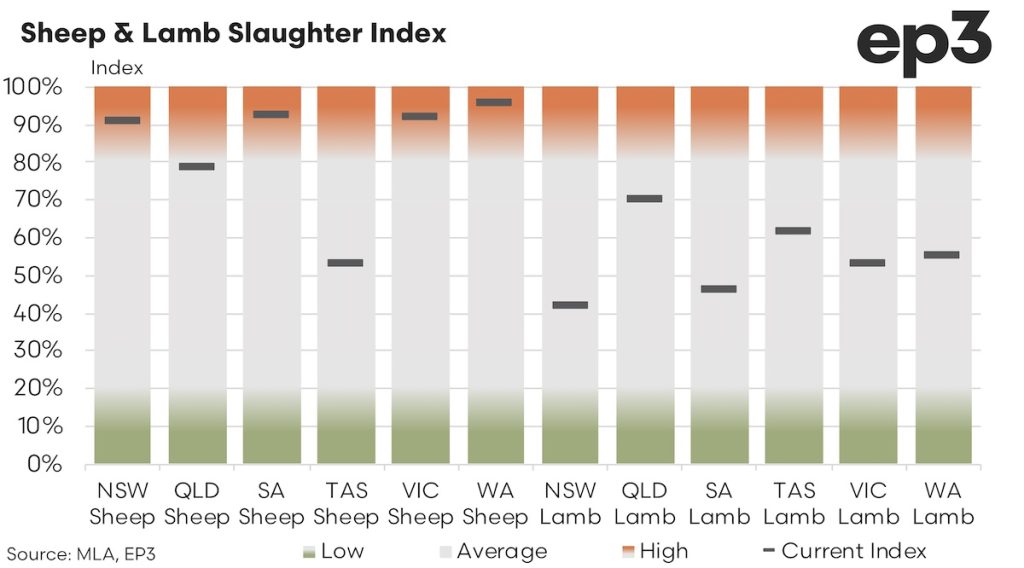

A comparison of the sheep versus lamb slaughter index scores across the country highlights the strong preference across most Australian states to favour mutton processing over lamb remains. Although, as we reported last week, lamb numbers are now starting to present as the spring flush begins to ramp up for 2024 and this is seeing an increase in the lamb slaughter index over the last month across several Australian states.

New South Wales has seen their lamb slaughter index score lift from 27% to 42% over the last month, in contrast the NSW sheep slaughter index has climbed from 75% to 91%. A reminder than this index score is basically a percentile ranking of current weekly slaughter volumes versus historic slaughter volumes over the last five years and this demonstrates that in NSW current lamb slaughter levels are higher than 42% of historic records while NSW sheep slaughter is presently sitting higher than 91% of historic records.

Victoria hasn’t seen the same lift in sheep slaughter as noted in NSW over the past month, but is has remained consistently strong sitting at 92% presently versus the 93% it was measuring a month ago. It has seen a lift in lamb slaughter though with the Victorian lamb slaughter index climbing from 36% to 53% over the last month.

South Australian sheep meat processors mirrors the pattern set in Victoria with the SA lamb slaughter rising from 36% to 46% during the last month. Meanwhile SA sheep slaughter has reversed the Victorian numbers climbing from 92% a month ago to sit at 93% presently.

In Western Australia the sheep slaughter index has climbed from 91% to 96%, and is holding the highest sheep slaughter index ranking in the country at the moment. The WA lamb slaughter index has lifted from 49% to 55% over the last four weeks.

Tasmania is the only state to have their lamb slaughter index sitting higher than their sheep slaughter index, with both index scores showing impressive gains over the month. The sheep slaughter index in Tasmania has a lifted from 18% to 53% and the lamb slaughter index score has risen from 29% to 62%.

Queensland is a relative minnow when it comes the sheep meat processing these days, especially when compared to the slaughter volumes reported from the other states. However, as an index ranking it has the highest lamb slaughter index across the nation presently with the Queensland lamb index increasing from 65% to 70% over the last month. The Queensland sheep slaughter index also saw a mild increase over the month to lift from 72% to 78%.