Beef Processor Trading Conditions – December 2024 update

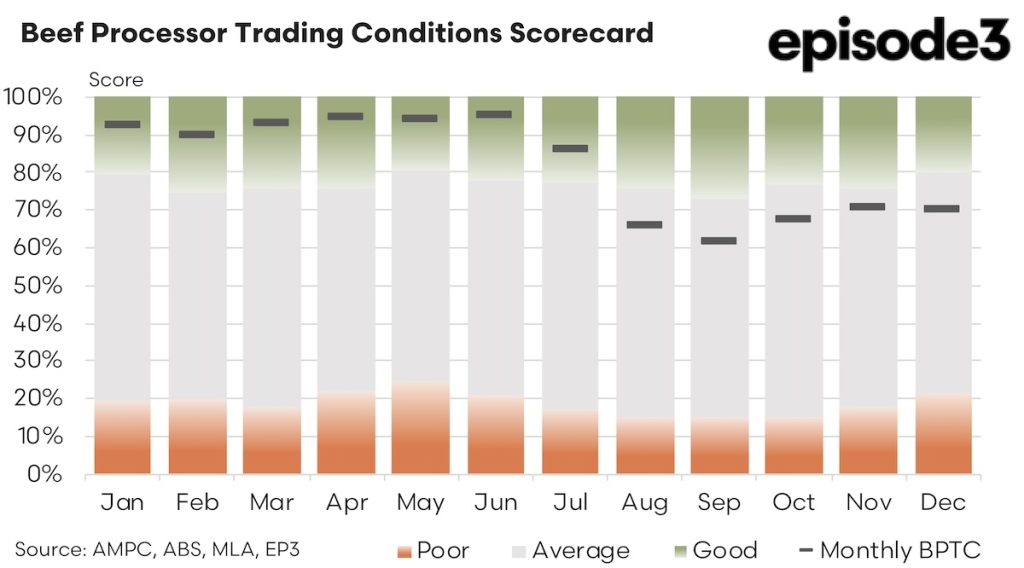

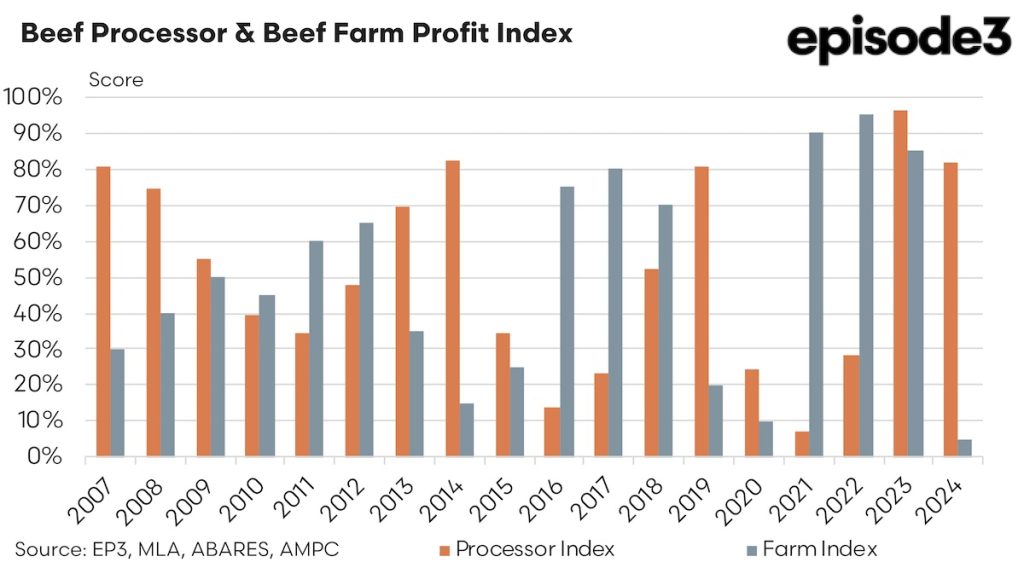

The Beef Processor Trading Conditions (BPTC) index concluded 2024 on an optimistic note, illustrating a significant improvement in annual conditions for beef processors compared to historical averages.

The index reached an annual score of 82%, signifying that the conditions experienced by beef processors in 2024 were superior to those encountered in 82% of the historic records since 2007. This high score reflects a robust trading environment for processors, likely driven by favourable market dynamics due to the tight supplies and high prices evident in Australia’s biggest beef export destination and most important beef trade competitor – the USA.

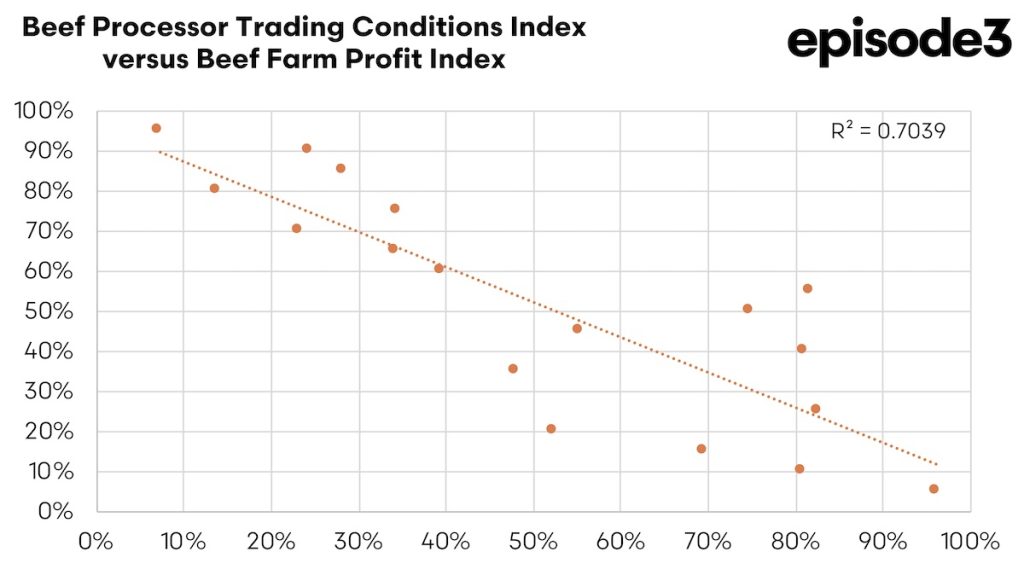

A detailed examination of the BPTC’s relationship with beef farm profitability reveals a complex interplay. The strong negative correlation between these two indices, evidenced by an R-squared value of 0.7039, indicates that approximately 70% of the variance in farm profitability annually can be explained by fluctuations in processor trading conditions. This inverse relationship suggests that improved conditions for processors tend to precede lower profitability for farms, and vice versa. This correlation could be influenced by factors such as market pricing, the status of the cattle herd rebuild/liquidation cycles, and external economic conditions affecting both ends of the beef supply chain differently.

Throughout 2024, several factors contributed to the positive trading conditions for beef processors. The last quarter of 2024 saw a decrease in beef cattle input costs, which include prices for heavy steers, processor cows and young cattle, enhancing profit margins for processors. Additionally, beef export receipts remained steady or strengthened, buoyed by robust demand in key international markets. This combination of lower input costs and strong export performance likely underpinned the year’s favourable BPTC score.

On a month to month basis, the BPTC saw a modest increase from 70% in November to 71% in December. It is important to note that such index scores can be revised post-publication as more data becomes available, potentially altering the perception of trading conditions retrospectively.

Export trends also played a crucial role in shaping the 2024 trading conditions. Australian beef processors benefited from increased prices in exports to the USA, Japan, and South Korea, which saw rises of 0.7%, 6.0%, and 2.4%, respectively. These gains reflect strong market demand and improved trade dynamics in these regions. Conversely, the decline in beef export prices to China by 8.0% highlighted challenges such as a slowing economy and weakening consumer sentiment in China, which negatively impacted demand for imported beef.

The interdependence of processor and farm profitability, while reflective of current economic conditions, also points to broader industry trends and challenges. For example, the reduction in cattle prices, with heavy steers, feeder steers, processor cows, and young cattle all seeing price declines between 3-4% over the final quarter of 2024, poses significant implications for farm revenues and profitability. Such price trends underscore the delicate balance processors and farmers must navigate in responding to market supply and demand dynamics.

Moreover, the beef industry is increasingly influenced by global economic factors, consumer preferences, and regulatory changes. Issues such as sustainability and animal welfare are becoming more prominent, affecting consumer buying behaviour and, consequently, processor and farmer strategies. Adapting to these changing demands while maintaining profitability requires strategic planning and adaptation by all stakeholders across the beef supply chain.

In light of these conditions, the future success of the beef industry appears contingent on several factors. Technological advancements, such as automation in meat processing and increased efficiency in cattle farming methods, offer opportunities for productivity improvements and cost reductions. However, these advancements also require significant investment and pose adoption challenges, particularly for smaller operators.

The role of environmental considerations cannot be overlooked either. Given much of the global community perceives that the beef industry has a high environmental impact, beef processors and farmers may need demonstrate their sustainability credentials more aggressively. This may also include the consideration of changes to how cattle are raised, fed, and processed, potentially altering traditional industry practices and economics.

The Australian beef industry’s landscape in 2024 has been shaped by a combination of favourable trading conditions for processors and challenging dynamics for farmers. The strong performance of the BPTC indicates robust processor conditions, but the negative correlation with farm profitability highlights the complexities of the industry. Moving forward, the sector will need to navigate these challenges through innovation, adaptation to market demands, and strategic collaboration between processors and farmers. This approach will be crucial in ensuring the industry’s sustainability and profitability in the face of evolving economic, environmental, and technological pressures.