Beef Processor Trading Conditions – February 2025 update

The Australian beef industry’s dynamics between cattle farmers and processors often reflect a delicate balance where profitability for one group tends to inversely affect the other. Recent developments from the fourth quarter of 2024 through to February 2025 highlight how quickly conditions can shift, influencing the Beef Processor Trading Conditions (BPTC) index.

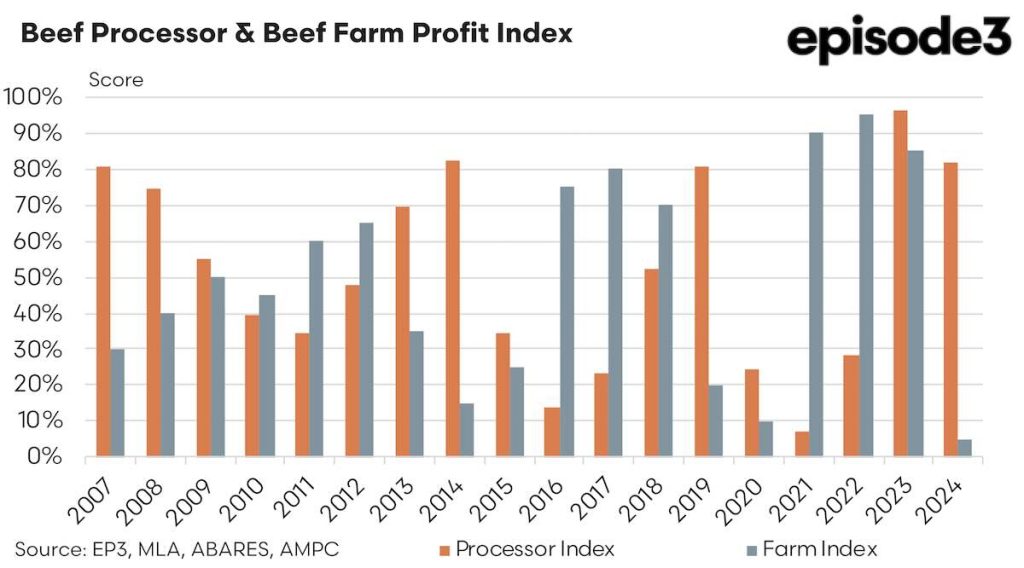

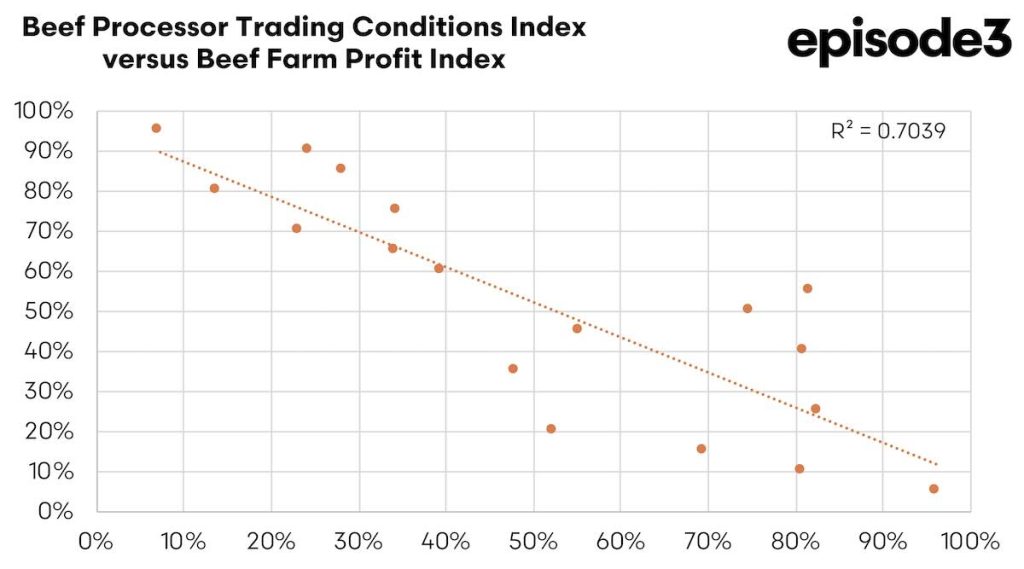

In 2024, beef processors in Australia experienced favourable conditions, ending the year with an annual average BPTC index score of 82%, which suggested conditions were better than 82% of historical instances since records began in 2007. This strong result for processors generally implies downward pressure on cattle prices, affecting farm profitability negatively. Indeed, historical correlation shows that roughly 70% of fluctuations in farm profitability are explained by changes in processor conditions. This relationship, as a negative correlation, implies that improved processor conditions often comes at the expense of Aussie beef producers, and vice versa.

However, conditions began shifting as we entered 2025. Key cattle market metrics showed a notable increase in cattle prices from the end of 2024 to February 2025. Specifically from the final quarter of 2024 to the first few months of 2025, heavy steer prices increased by 5.4%, young cattle prices rose by 4.7%, and processor cow prices climbed 5.5%. Such price increases reflect improving conditions for beef producers but simultaneously represent higher input costs for processors, potentially compressing processor margins.

It is important to note that cattle input costs for processors only tells part of the story, it is also important to see what they are receiving at the other end of the trade. Aussie beef export values also underwent subtle changes. The U.S. market—presently Australia’s most important beef trading partners—saw export values increase by 4.5%. Similarly, South Korea experienced a positive growth of 3.1%, and even China, which had previously recorded a substantial downturn in late 2024, rebounded with a 5.1% increase. Conversely, Japan, another key market, experienced a decline in export values of 3%. Such diverse international market conditions emphasise the complexity and volatility processors must navigate.

Domestically, retail beef prices rose modestly by 0.5%, reflecting steady local consumer demand. At the same time, processing costs decreased slightly by 0.3%, partially offsetting the higher cattle procurement costs processors were facing. This subtle reduction in operating expenses was beneficial, but likely insufficient to fully counterbalance the increase in cattle prices.

Unfortunately there have been some delays in the Meat & Livestock Australia reporting of co-product values beyond October 2024 so we are unable to assess additional receipts coming into processors from the sale of non-meat items. Once the data is available we will update the monthly BPTC retrospectively to realign the scores.

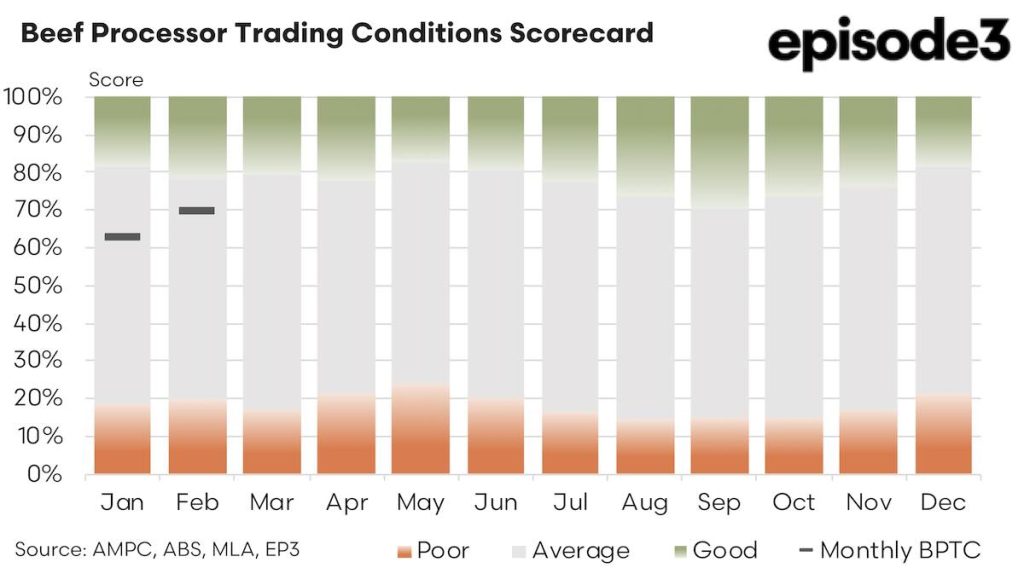

These combined changes, outlined above, translated directly into the Beef Processor Trading Conditions index scores for early 2025. In January, the BPTC was recorded at 63%, marking relatively favourable conditions despite falling somewhat from the highs of late 2024. By February, the index improved to 70%. Given the structure of this index, similar to a rain gauge decile ranking, a score of 70% indicates that conditions for processors were better than 70% of historical observations—a solid and reasonably good outcome.

The BPTC index works precisely by comparing current conditions (including input costs, export receipts, and domestic pricing) against historical records. A score above 50% means conditions are better than average, and reaching 70% confirms that processors remain in a relatively comfortable position historically.

However, this improvement for processors remains nuanced. While export market improvements, particularly in the critical US and rebounding Chinese markets, undoubtedly supported processor revenues, increased cattle prices from farms signalled that producers were regaining leverage. This demonstrates the ongoing tension and balance inherent within the supply chain: improving farm profitability generally occurs at processors’ expense unless offset by corresponding increases in export prices or domestic sales.

Moving forward, both sectors—processors and cattle farmers—face evolving pressures. Processors will need to strategically manage procurement costs amid rising cattle prices, especially if export market dynamics shift unfavourably or domestic consumption weakens. Meanwhile, cattle producers, buoyed by improved prices, must still navigate external pressures such as difficult seasonal conditions, sustainability initiatives, evolving consumer preferences, and increasing regulatory oversight.

Technological advancements, sustainability certifications, and market diversification will likely become essential strategies for both sectors to maintain profitability. Collaboration across the beef supply chain will be paramount, enabling adaptability to shifting market signals.