Market Morsel

On social media this week President elect Donald Trump has outlined one of his first tariff related impositions once in power in 2025 will be a 25% import tax on items coming into the USA from Canada and Mexico. In terms of the meat sector this could be of benefit to other countries importing meat into the USA, like Australia, if Aussie imports are not subject to the same tariff regime.

This article takes a look at the live animal trade and meat trade that enters the USA annually to see how reliant the US is on Canada and Mexico, and which other nations are in the mix when it comes to imports of livestock and meat products.

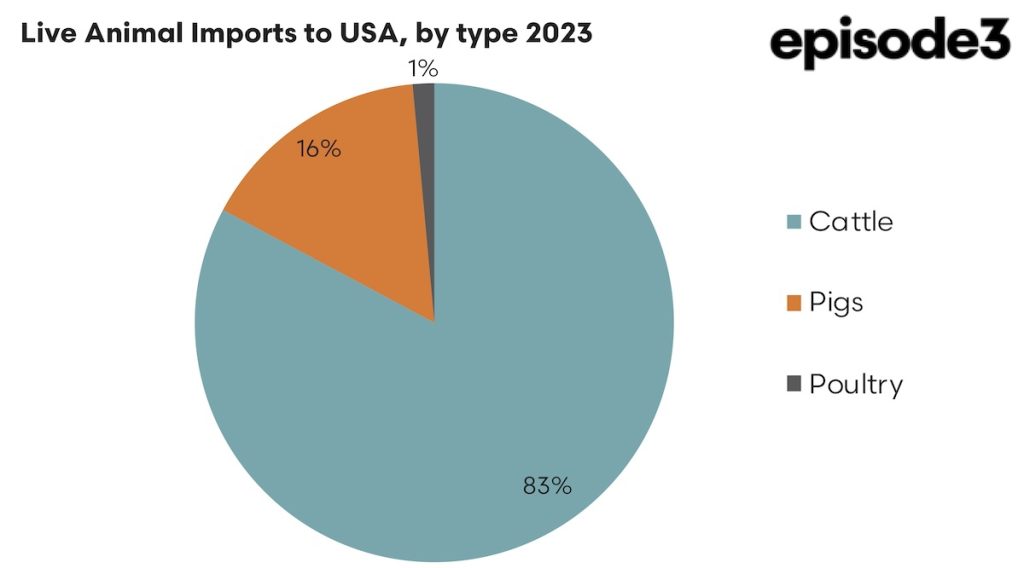

In terms of type of livestock imported into the USA, the trade is dominated by cattle and then pigs. In 2023 United States Department of Agriculture (USDA) data highlights that, by value, 83% of animals transported into the USA were cattle and 16% were pigs. Only 1% of the trade value was for poultry. There is also a very small trade of sheep & goats but it is only around 0.04% of the value so we elected to exclude this from the chart as it isn’t that visible on the visual when added.

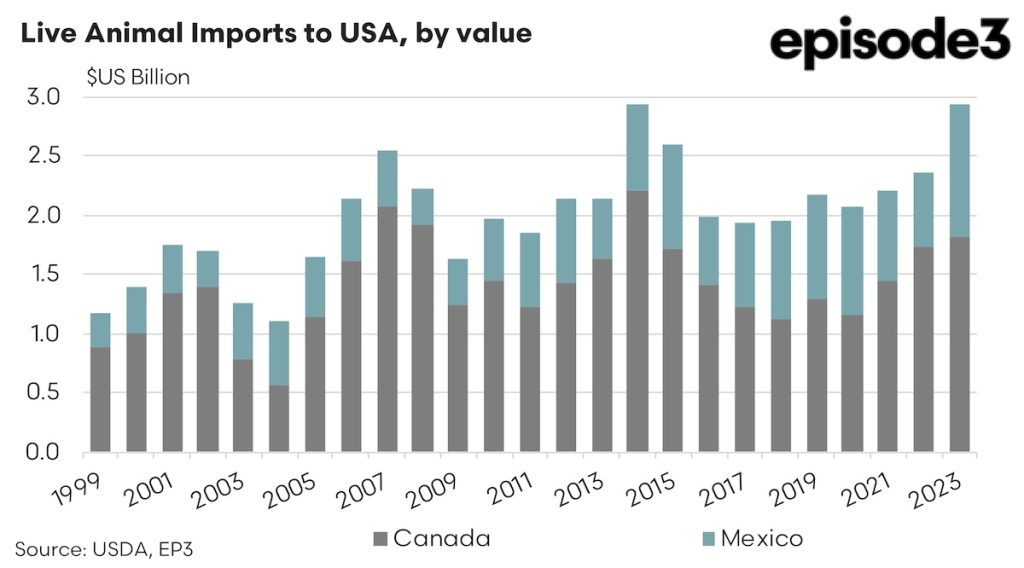

The two source nations for all imported livestock are Canada and Mexico, with Canada holding the majority share of the trade by value. In 2023 the live trade totalled $US2.9 billion across all livestock types, Canada sent $US1.8 billion worth of livestock and Mexico transported $US1.1 billion. In terms of the type of animal sent Mexico only sent cattle. In contrast Canada sent $US1.3 billion worth of cattle, $US462 million of pigs and $US43 million of live poultry.

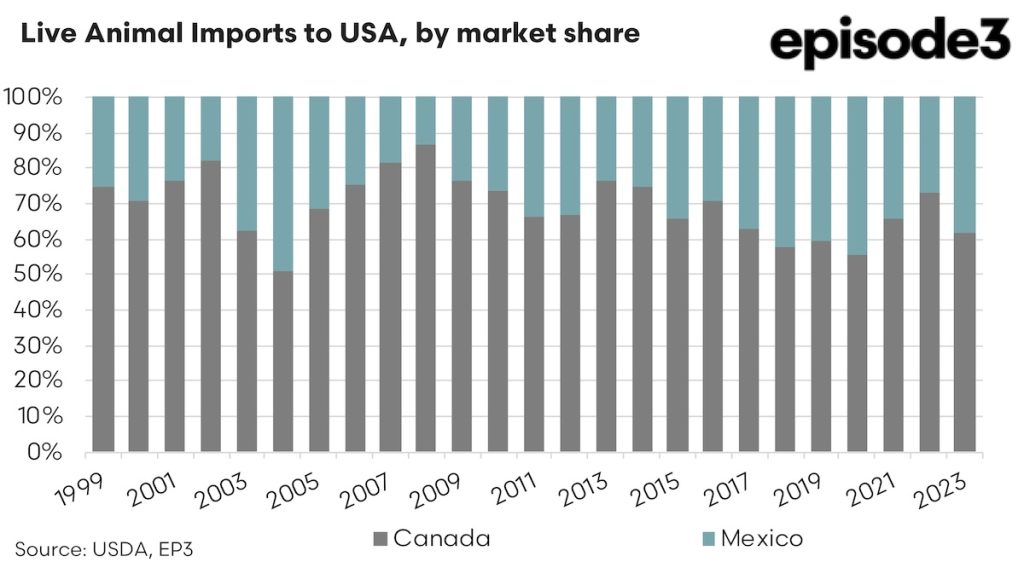

In terms of cattle and pig numbers imported into the US in 2023 there was a total of 8.7 million animals imported, consisting of around 2 million cattle and 6.7 million pigs. Meanwhile poultry imports were noted at around 12.2 million birds. In terms of market share Canadian flows into the USA of all livestock was around 62% of the value of the trade in 2023 and the Mexican share was 38%. This proposed 25% tariff on live animals coming from Canada and Mexico will add to the import costs of feedlots and meat processors in the USA and eventually flow through the supply chain to increased meat cost to the US consumer.

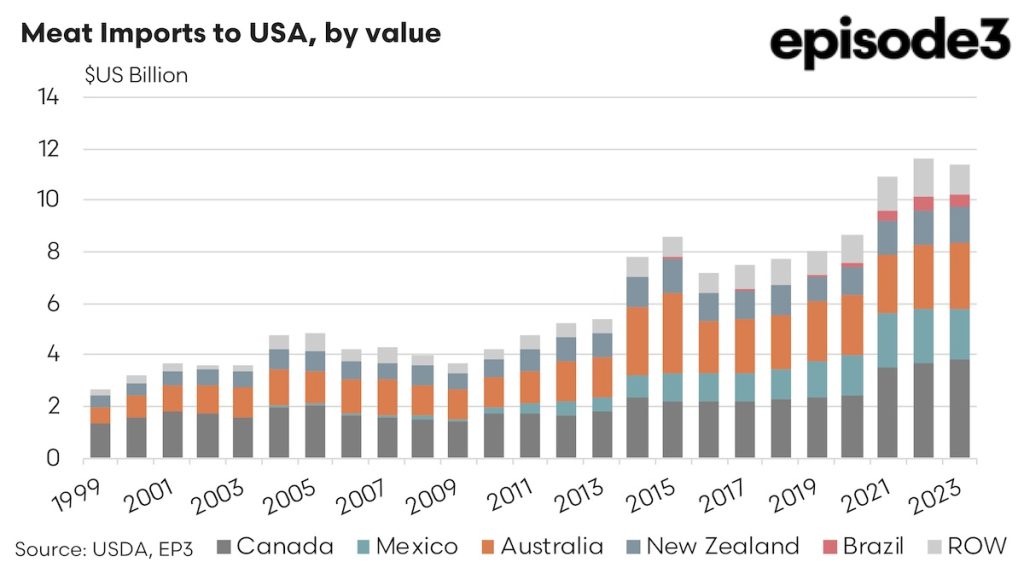

Speaking of meat costs rising for the US consumer, lets take a look at the landscape for the meat import trade into the USA. Compared to the live trade the meat import sector is much larger with a total trade value of $US11.5 billon in 2023. In terms of meat type the value breakdown is as follows; $US6.2 billion fresh or chilled red meat/offal, $US4 billion frozen red meat/offal, $US376 million poultry/other meats and $US1.9 billion of salted, cured or smoked prepared meats.

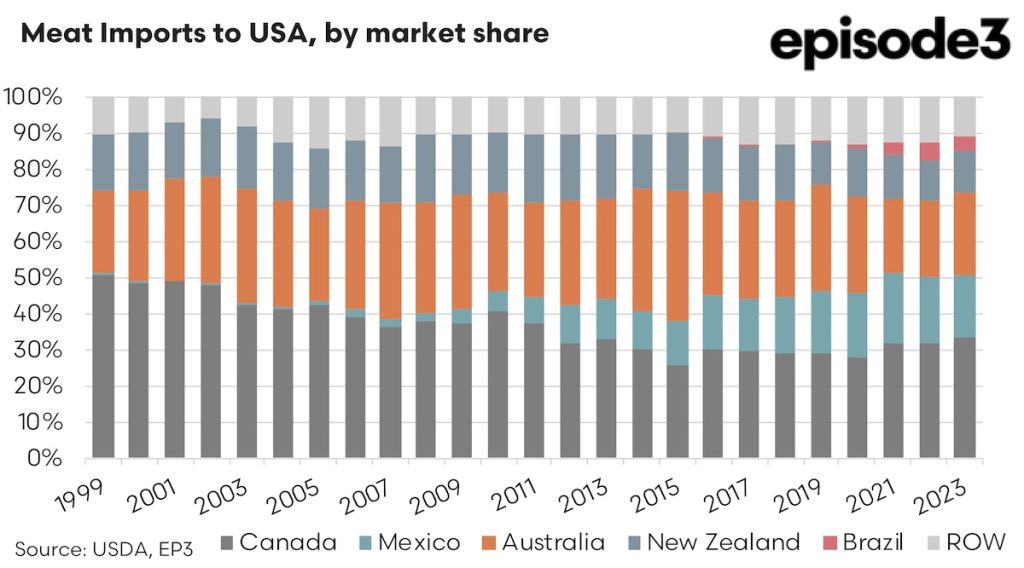

Taking a look at the market share of the meat trade by source country we can see that Canada and Mexico feature heavily with each country accounting for $US3.8 billion and $2 billion of the total meat trade in 2023, respectively. In terms of market share of the total meat trade into the USA, Canada sits in top spot with a 33.2% share last year and Mexico in third top position with 17.4% of the trade. Interestingly Australia hold the second top spot with nearly 23% of the trade with a trade value of $US2.6 billion in 2023. The Kiwis also feature prominently in 4th spot with $US1.3 billion or around 12% and in recent years Brazil has begun to capture some market share with $US478 million of trade flows in 2023, or around 4% of the total trade.

It will be interesting to see if Australian products, like beef and sheep meat, get slapped with a tariff too – and if they do will it be as high as 25% or a little less punitive like 10%? An assessment of the trade balance between the USA and Australia across all imported good & services shows that Australia sits at a trade deficit, meaning Australia takes more imported in from the USA than the USA take from Australia.

Perhaps, in a Trump view of the world this will favour Australia as he may view the Aussie trade as being more favourable to the US interests given we run at the trade deficit and America runs at a trade surplus. If this is the case he may elect to go easy on Australia and that could be a benefit, particularly for our red meat access. Time will tell.