Market Morsel

A month ago, processors from southern Australia were actively securing slaughter cattle in the northern regions. However, the trend has recently reversed due to warmer weather and a lift in cattle availability in Victoria, southern NSW, and eastern South Australia. This surge has made the transport costs to Queensland more worthwhile, prompting Queensland processors to start purchasing cattle and arranging transportation.

With the seasonal decline of cattle runs from western and northern areas, Queensland is facing a tighter local supply. Toward the end of October cattle were reported being transported into Queensland from as far south as Carcoar due to the shift in supply dynamics.

Significant rainfall ranging from 25 to 100mm has been recorded recently, which has further tightened the already dwindling cattle supply, leading to numerous weather-related delays and postponements, particularly in Queensland.

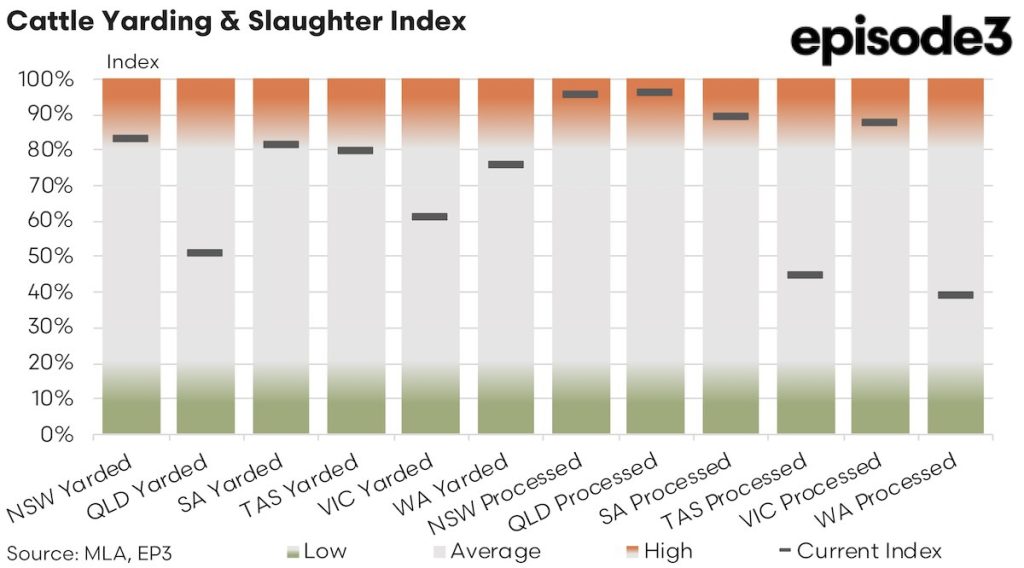

Over the last month the QLD cattle yarding index score has dipped from 59% to 50% reflective of the tighter sale yard supply scenario in the north and contrasts to the increased yarding index seen in the south. For example, in NSW the cattle yarding index has increased from 67% to 83% over the last month.

Beef export figures for October have set a new record at just over 130,000 tonnes, indicating a steady increase in processing capacity since mid-year. October’s beef processing figures surpassed those of any period since December 2019, when drought conditions had intensified slaughtering activities, with nearly 554,000 head of cattle processed during October 2024. Compared to last year, weekly processing numbers for the October period were up by 50,000 head.

Barring weather-related disruptions, the final quarter of 2024 is on track to be the most robust production period since late 2019. The Melbourne Cup holiday saw a slight dip to weekly slaughter volumes with 140,000 head of cattle processed, but the recent national slaughter tally has seen the weekly numbers nationally climb back towards 146,000 head.

The mainland eastern states are all reporting cattle slaughter index scores in the high 80s to mid 90s, with NSW and Queensland based meat works registering a score of 96% apiece, with demonstrates that current processing volumes in the north are running higher than 96% of all weekly records over the last five years.

There has been little change in direct consignment prices across eastern and southern Australia in the last week. Some Central Queensland plants are nearly fully booked, with only about a week of processing capacity left before the anticipated seasonal closures in as we approach a potential 20th December shut down.

With the season ending soon for some Central Queensland plants, they are nearing their supply capacity for 2024. Meanwhile, southern Australia, less affected by recent rains, continues to send a steady supply of cattle back to Queensland for processing due to local plants operating at full capacity.

Despite the warmer weather boosting southern cattle supply over the past month, slaughter grid offers in major Queensland and southern state plants have remained stable. Some Queensland processors have raised their grid prices by 20c/kg into the first few weeks of November while others are holding off on adjustments despite the supply pressure.

Current price ranges for slaughter ready steers in Queensland saleyards have lifted around 20 cents over the last four weeks, mirroring the increased grid pricing, to sit at 335c/kg on a live weight basis. In Victorian sale yards the heavy steer price has slipped around 15 cents over the month to sit at 320c/kg lwt, meanwhile NSW heavy steers have broadly trekked sideways with prices holding relatively steady at 325c/kg.

Away from the mainland, processing index scores in Tasmania and WA are demonstrating much lighter throughput volumes with Tasmania sitting on 44% and WA at just 39%. The less robust processing activity in Tasmania contributing to a sharp fall in the Tasmanian heavy steer price over the last month with a 70 cent drop noted. As of 25th November the Tasmanian heavy steer was sitting at 260c/kg lwt and the WA heavy steer indicator has been trapped in a 220-270 cent range since late September, currently sitting at 260c/kg lwt.

The record beef export figures for October underscore the sector’s resilience and ramping up of processing capacities seen during this year, positioning the final quarter of 2024 to potentially surpass recent years in terms of production volume. As the year draws to a close, saleyard cattle supply and direct consignment trends across the country remains a critical watch area due to the fluctuating turnoff levels and the impending seasonal plant closures at the end of December.