Key Points

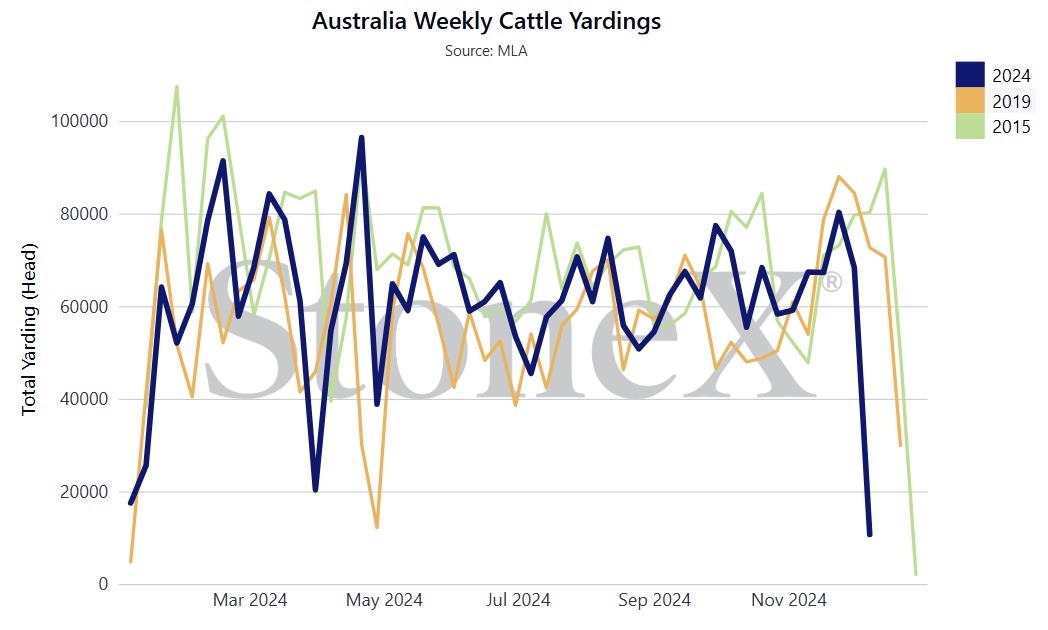

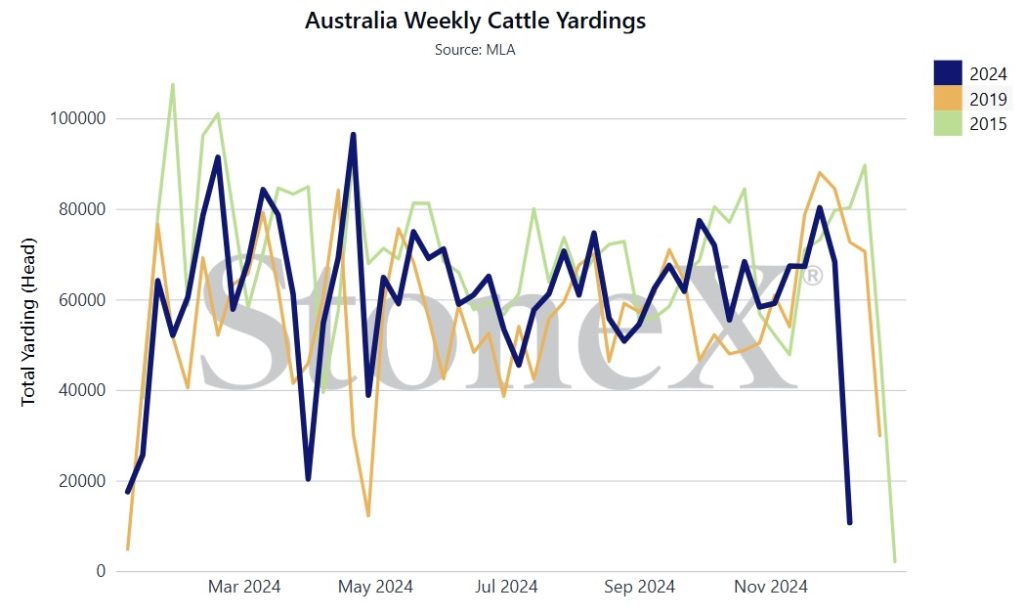

- 2024 saleyard cattle supply sitting between the 2019 and 2015 drought induced liquidations, indicating how strong the numbers have been this year.

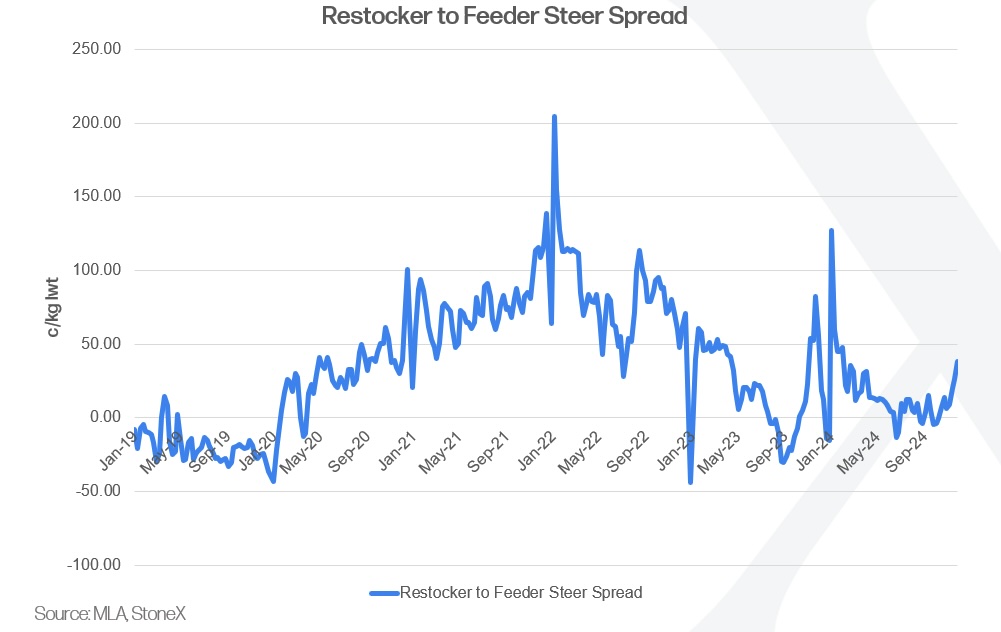

- Restocker to feeder steer spreads reached their highest level this week at +35c/kg lwt, since February this year, as restockers and traders follow the lead of higher spot feeder steer prices and rain.

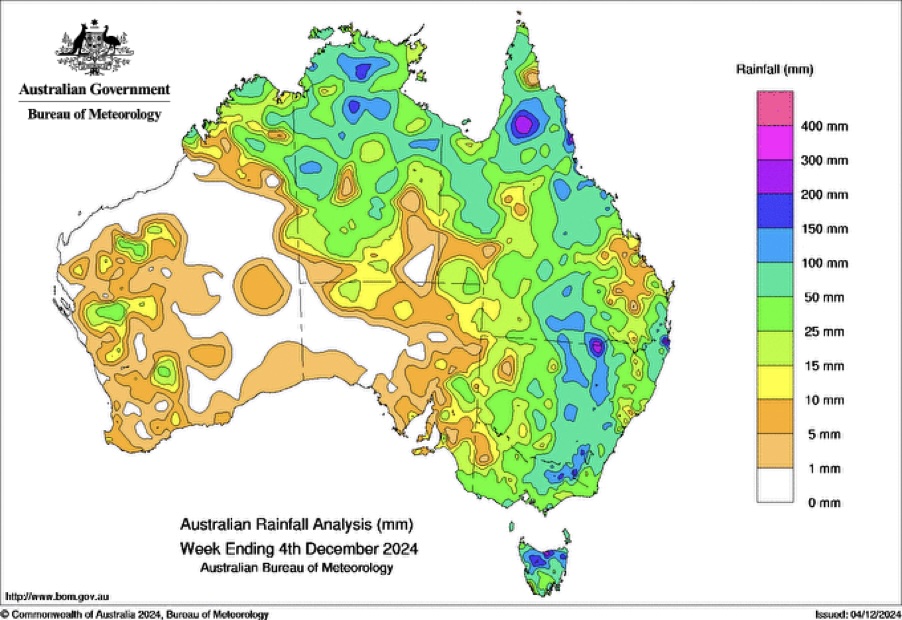

- Further forecasted falls for QLD over the next week (if it comes) will deliver good numbers of heavier, well-conditioned cattle to the market in Q1 2025 with grazing conditions and feed bases in a very positive place for these areas at the minute.

Supply

- 2024 saleyard cattle supply has, for the most part, operated between the drought induced liquidation year of 2019 and the previous cattle cycle drought of 2015.

- Despite more cattle transactions occurring direct out of the paddock, the saleyards continue to play a major role in Australia’s beef industry through the marketing of stock.

- This information indicates supply is in line with previous heavily drought influenced years, without question the south has been in drought in 2024, elevating their supply, but the north has not, which points towards cattle numbers more than anything.

- Timely rain, the driver of disappearing space booking supply and a reduction in saleyard marketings, although it wouldn’t be surprising to see a week or two of strong supply before the year ends as producers look to move cattle.

- Based on NLRS weekly cattle slaughter numbers, average YTD 2024 weekly kills are ahead of 2023 levels by 14% or 16,400 head.

- Paddock cattle that were booked at a price continue to move, Angus steers are a good example, so despite the rains, volumes need to flow.

Demand

- A burst of restocker confidence at play in the markets at present, which is why we are seeing a strong divergence of feeder and restocker prices. With restocker steers at the largest premium at +35c/kg lwt (nationally) to feeder steers since early February this year when the market reached early highs for 2024 (ignore the spikes in the spreads, these are from very early sales in January of each year when a lack of sales are reported).

- As I mentioned last week, feedlots lifting their bids in the past fortnight is encouraging restockers to compete, coupled with the rains, promising good weight gain and growing conditions for QLD traders and backgrounders for the next 6-8 weeks.

Price

- Markets firmed again this week with rises across the board, processors scrambling to fill space bookings after the rain and an improving US 90’s imported market have driven lifts in the heavy cattle.

- Southern markets and grids found some support this week following falls throughout VIC, east SA and southern NSW, reversing the trend of declining prices seen across these regions in the past few weeks.

- Before the end of this year, Angus feeder steer prices may fall to a discount (based on Argus) against Flatback feeders – this could be as early as tonight when Argus pricing is released.

- Looking ahead à the end of 2024 I think will see this market continue to firm a little more, the good forecast for rains and with the ball already rolling it should see it remain that way.

Weather

- The above 7 day totals chart from the BOM give a clear indication to why prices are kicking, reminding us how much of an influence the weather has over cattle markets in Australia.

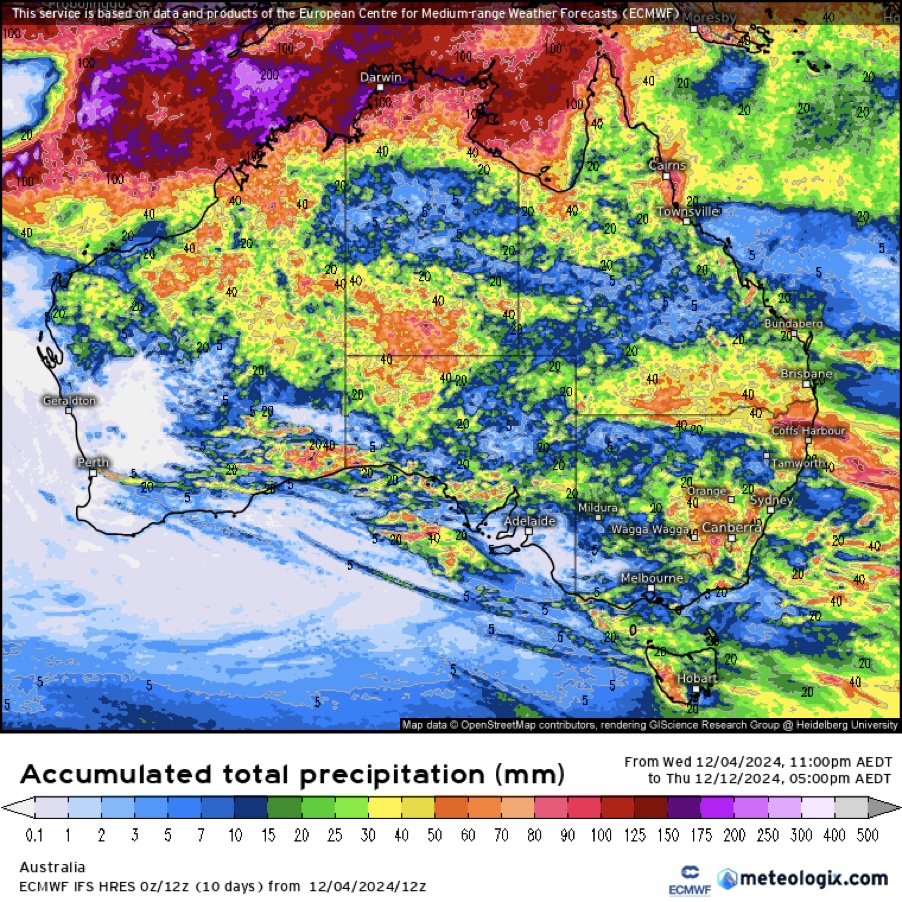

- European Centre for Medium-Range Weather Forecasts (ECMWF) 7 day total precipitation forecast below – further rains on the way, really setting up southern QLD for an excellent summer if this change delivers.

- Expect good numbers of heavy cattle to be on the market in Q1 2025, with weight gains to be very solid.

Ripley Atkinson | Australian Livestock & Commodities Manager

M: +61 427 417 803

www.stonex.com | ripley.atkinson@stonex.com

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727)

Suite 28.01 | 264 George Street | Sydney | NSW | Australia

NASDAQ: SNEX

StoneX Disclaimer

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business.

StoneX Financial Pty Ltd (ACN 141 774 727) holds an Australian Financial Service License (AFSL: 345646) for Dealing in Securities, Exchange-Traded Derivatives Contracts, OTC Derivatives Contracts and Foreign Exchange Contracts, and is regulated by the Australian Securities and Investments Commission.

‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.