Market Morsel

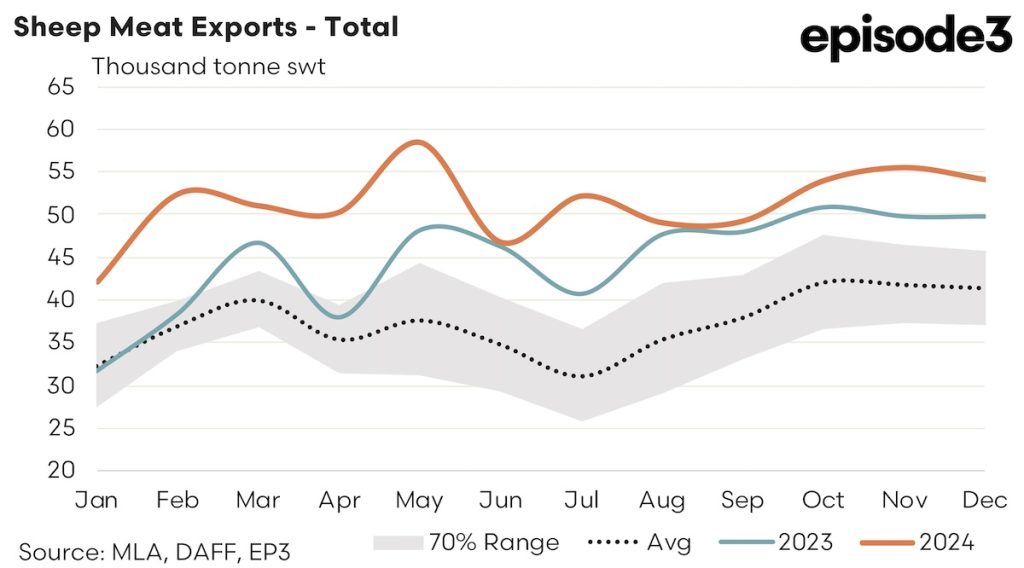

The final month of trade data has been released for 2024 for Australian sheep meat export flows and it highlights a solid end to the season. During the final quarter of 2024 there was a total of 163,362 tonnes of sheep meat exported offshore (mutton & lamb combined), nearly a 9% increase on the volumes shipped during Q3, 2024.

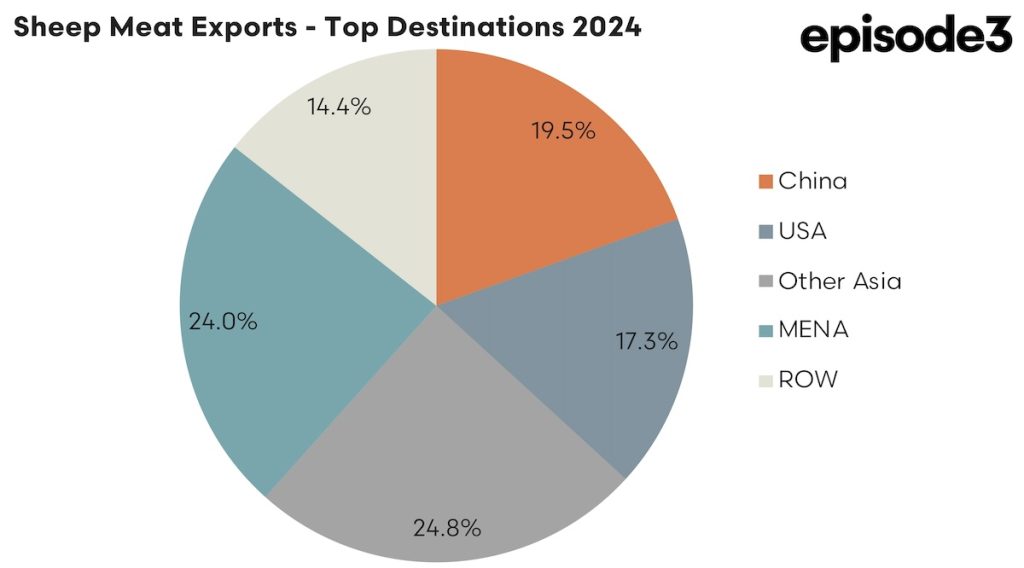

Compared to the final quarter of 2023 the current season also saw volumes running 9% higher. Furthermore, looking at the five year average volumes seen exported during Q4 volumes for the final quarter of 2024 ended up coming in 30% above the average seasonal levels. As individual destination countries China was the top destination for Aussie sheep meat exports during 2024 with 19.5% of the trade, followed by the USA with a 17.3% share of export flows. The remaining countries in the Asia-Pacific region, such as Malaysia, Singapore, Japan, PNG, Taiwan, etc, took neary 25% of the sheep meat flows and the Middle East & North African region accounted for 24% of the trade.

In terms of the top trade destinations for Australian sheep meat exports, the following was noted.

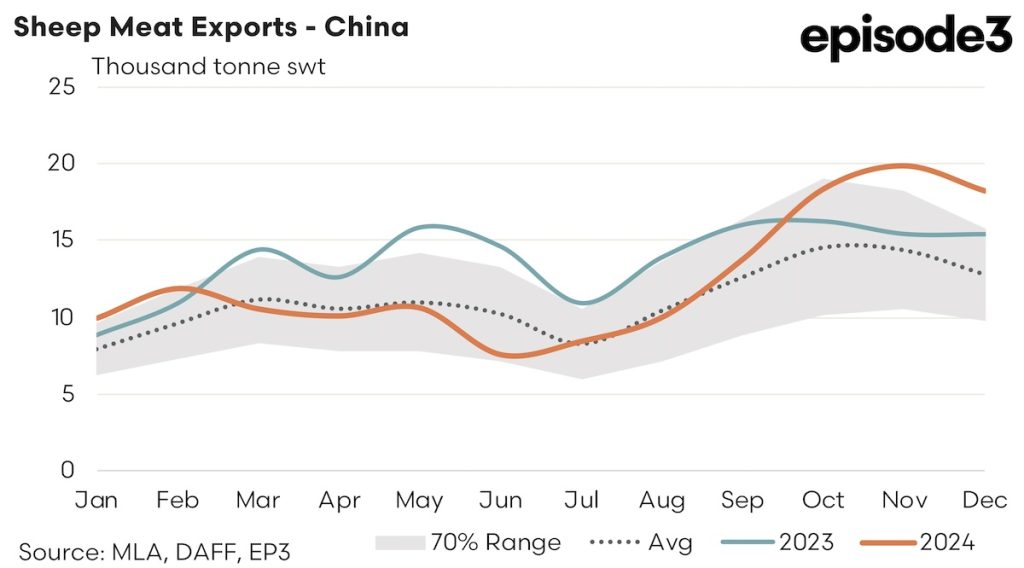

China – During the final quarter of 2024 Chinese demand for Aussie sheep meat surged by 76% compared to the volumes exported during Q3, 2024 to reach 56,533 tonnes. These levels are 20% higher than the export levels seen during Q4, 2023 and 36% above the average Q4 trade volumes, based on the last five years of the trade.

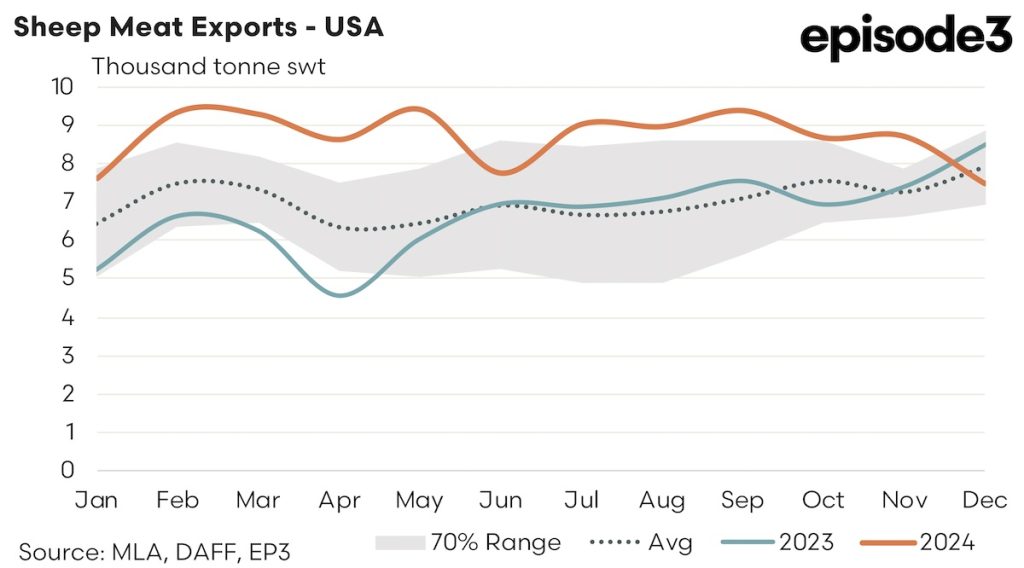

USA – The US demand for Aussie sheep meat eased a little over the last quarter of 2024 to see 24,859 tonnes exported. While this volume was still 9% higher than what was shipped during Q4, 2023 and 10% above the five-year average flows seen during Q4 it still reflected a 10% decline on the levels seen shipped during the third quarter of 2024. Much of 2024 saw sheep meat exports to the USA running 30-40% above the levels seen over the last few years so a more subdued end to 2024 was a little unexpected.

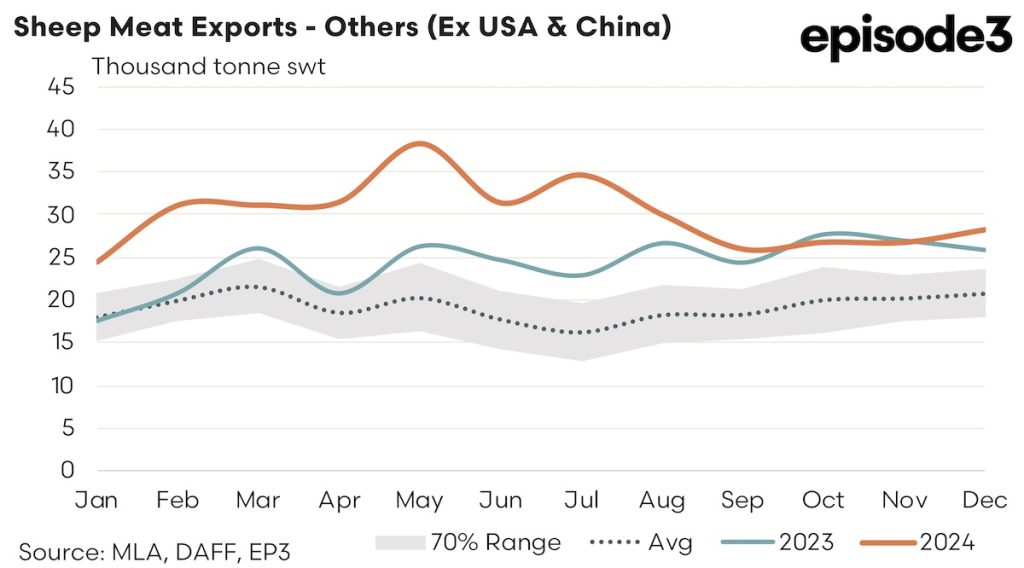

The others – The export flows of sheep meat from Australia to the “other destinations” remained at above average levels but eased from the very strong results seen during Q2 & Q3, 2024. There was 81,970 tonnes shipped to the other destinations over Q4, 2024, very similar levels to what was seen during Q4, 2023 but 34% higher than the Q4 average flows, based on the last five years of the trade. Q2 and Q3 this year saw trade levels 70-80% above the average flows to “other destinations” demonstrating how robust demand for sheep meat globally is becoming.