Market Morsel

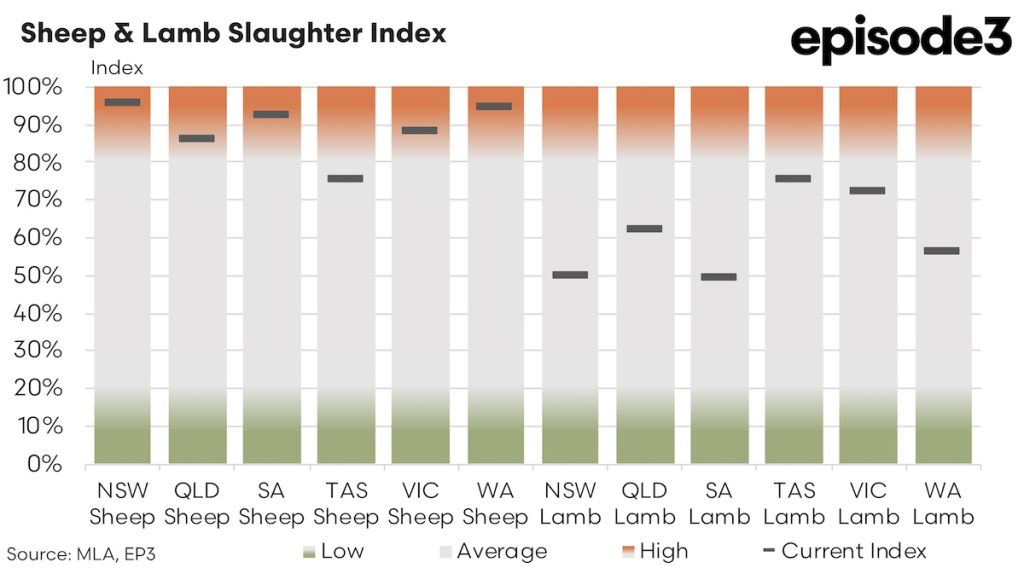

Australia’s livestock processing sector has witnessed diverse shifts in sheep and lamb slaughter dynamics as revealed by the latest slaughter index scores for November 2024. New South Wales (NSW) and Victoria, as the key drivers of the nation’s sheep meat processing, stand out with their distinct patterns. Meanwhile, other states like Tasmania and Western Australia show intriguing trends that reflect regional dynamics.

Victoria, the largest processor of lambs in Australia, also showed notable movements, albeit with a steadier trend in sheep processing. The sheep slaughter index remained high but dropped slightly from 95% in October to 92% in November. This minor decline may reflect some shift in processor focus as lamb supplies ramp up.

The Victorian lamb slaughter index rose from 52% in October to 73% in November, reflecting growing availability of lambs as the season progresses. Victoria’s consistent processing capability ensures it remains a cornerstone of Australia’s lamb industry, and the uptick in lamb slaughter is a positive sign for producers after a relatively slow start to the season.

Tasmania stands out as the only state where lamb slaughter surpasses sheep processing in relative terms. The sheep slaughter index rose significantly from 32% in October to 76% in November, reflecting a strong recovery in processing volumes. However, the lamb slaughter index reached an impressive 75% in November, up from 46% in October.

Western Australia maintains its dominance in sheep processing, with the sheep slaughter index reaching 95% in November, up from 32% in October. This substantial increase underscores WA’s strategic role in meeting global mutton demand, particularly given its proximity to key export markets in Asia.

Lamb slaughter in WA, while not as prominent as sheep, also showed an increase, with the index moving from 46% in October to 56% in November. This aligns with broader national trends as spring lamb supplies come to market.

In South Australia, the sheep slaughter index dipped slightly from 90% in October to 88% in November, but lamb processing saw a consistent rise from 42% to 50%. These trends reflect SA’s balanced approach to meeting demand for both sheep and lamb.

Queensland, though a smaller player in sheep meat processing, showed stable activity. The sheep slaughter index moved from 75% in October to 86% in November, while the lamb slaughter index saw a modest decline from 74% to 62%.

The substantial lift in lamb slaughter across most states reflects the arrival of spring lamb supplies, a critical factor in Australia’s livestock calendar. This seasonal boost has allowed processors to increase lamb volumes, even as sheep slaughter remains historically high due to strong export demand for mutton.

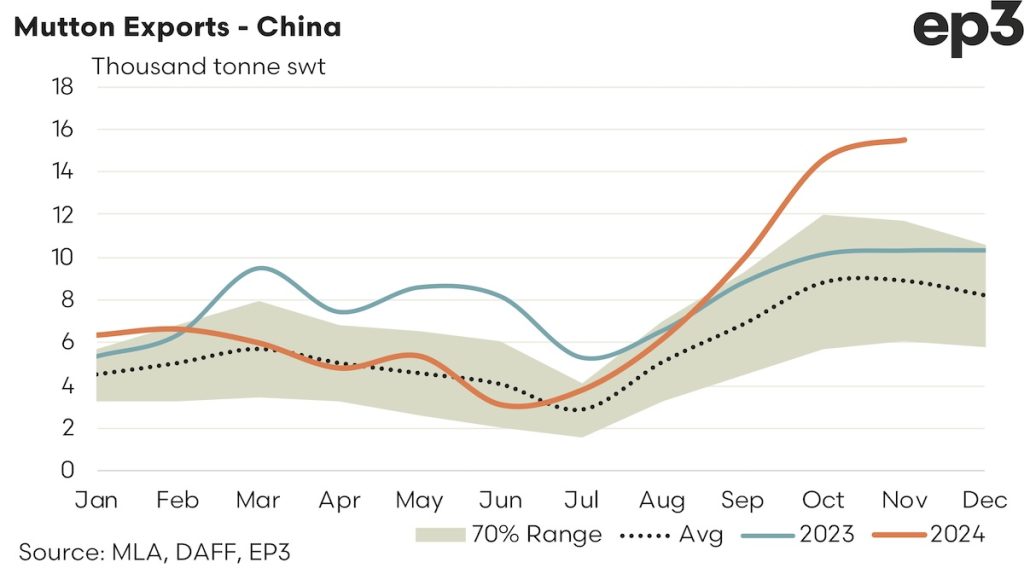

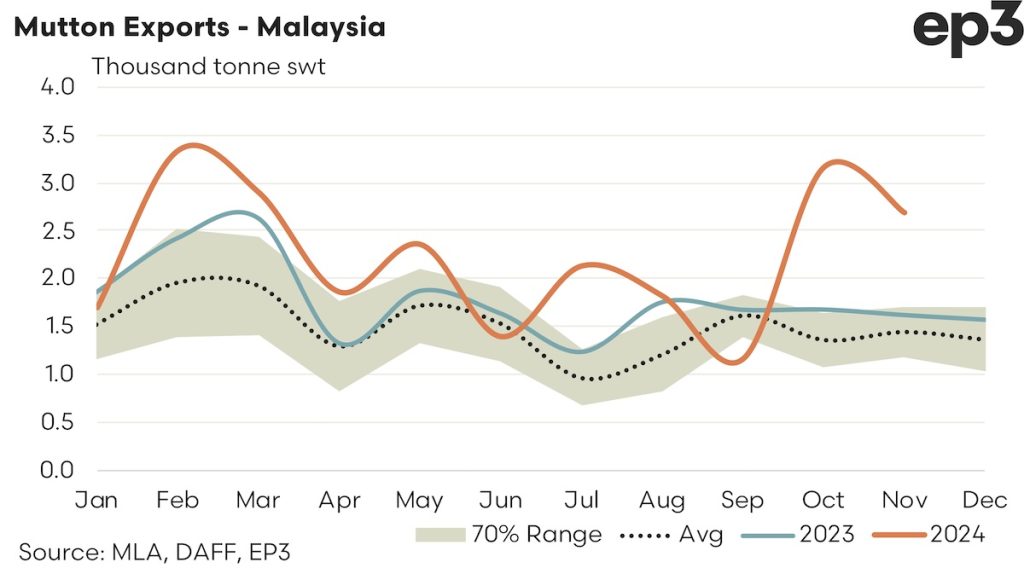

Export markets, particularly China & Malaysia, continue to drive demand for sheep meat, with mutton favoured over lamb in many cases due to its price competitiveness and suitability for traditional dishes. This has kept sheep slaughter at elevated levels, especially in WA, which are well-positioned to capitalise on this trend.

While the strength in sheep meat processing volumes is a welcome development for producers, it comes against a backdrop of challenging market conditions. Global economic uncertainty and fluctuating consumer sentiment, particularly in key export markets like China, may temper demand as we move into 2025. However for lamb producers, the increasing slaughter activity offers an opportunity to exploit the spring flush, particularly if export demand strengthens in other key markets like the USA and Middle East.