Market Morsel

Following a mixed return to market activity observed from December 2024 to January 2025, new data from February indicates further developments in cattle movements and processing throughput across the states. While some states have seen a more balanced progression, others continue to face bottlenecks and supply constraints.

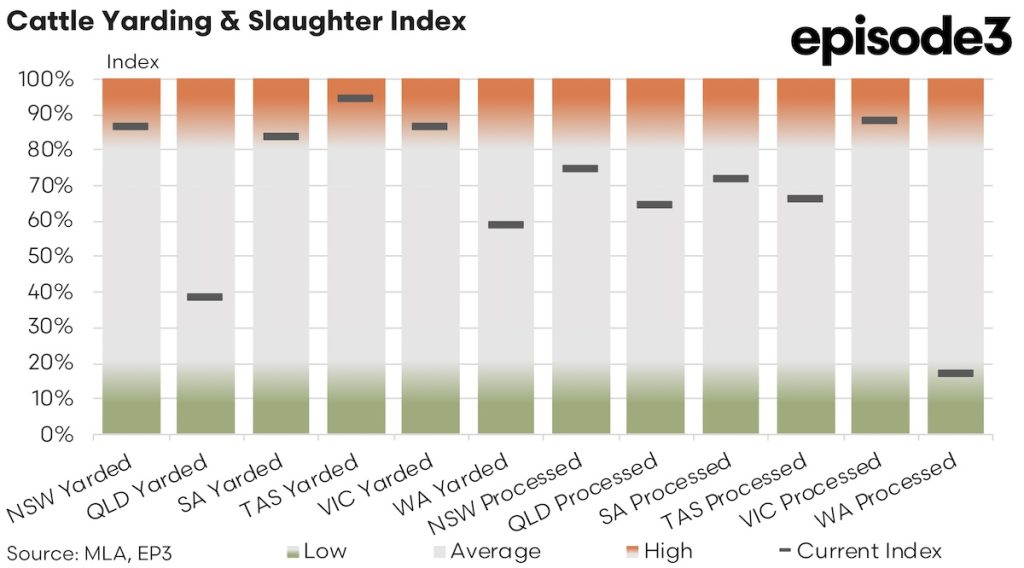

New South Wales has experienced a steady increase in yarding activity, climbing from 69% in January to 87% in February. This continued rebound suggests a sustained flow of cattle to market, aligning with the earlier trend of supply meeting processing demand. NSW’s processing activity has also improved, jumping from 49% to 75%, signalling stronger slaughter volumes.

Queensland, in contrast, has maintained relatively stable yarding activity at 38%, but processing throughput has surged from 31% in January to 64% in February. This sharp increase aligns with earlier reports that many Queensland processors were booked well into February on direct consignment, highlighting strong demand for slaughter-ready cattle.

Victoria has experienced relative stability, with yarding increasing slightly from 75% to 87%, while processing jumped from 71% to 88%. This reflects Victoria’s ongoing role in supporting national processing demand, particularly with Queensland processors leveraging southern cattle supplies.

South Australia has followed a similar trajectory, with yardings remaining high at 84%, down slightly from 95% in January but still reflective of above-average supply levels. Processing has continued its upward momentum, reaching 72% in February from 68% in January. This indicates a continued push to meet both local and interstate demand.

Tasmanian sale yards have seen a reversal in trends, with yardings lifting from 61% to 95% which is a significant shift that suggests a firm boost in cattle supply availability. Processing activity has risen in line with increased sale yard activity from 52% to 66%, reflecting an adjustment phase as processors work through existing cattle stocks.

Western Australia has seen one of the more striking divergences, with yardings falling from 86% to 59%, suggesting a market slowdown. WA beef processing has increased slightly from 16% to 17%, indicating continued constraints in slaughter capacity.

As noted in January, much of the early-season cattle turnoff has been driven by producer concerns over seasonal conditions, particularly amid recent heatwaves in south-eastern Australia. The latest figures indicate that this trend has persisted, with yarding remaining elevated in most key cattle-producing states. Queensland’s rapid processing increase suggests that processors are working through high cattle availability following earlier yarding increases.

The strong processing figures in NSW, VIC, and SA also highlight robust domestic and export demand, aligning with earlier reports of direct consignment bookings well into February. Despite these positive trends, WA’s processing challenges remain a bottleneck, likely reflecting workforce constraints and logistical hurdles.

Price movements over the last four weeks highlight notable trends in key cattle categories. The Heavy Steer Indicator has increased by 15c/kg over the past month, now sitting 52c/kg higher than this time last year at 348c/kg live weight. Feeder Steer prices have risen by 11c/kg over the past four weeks and are up 28c/kg year-on-year, reflecting continued strong demand for feedlot placements. The Processor Cow Indicator has gained 30c/kg in the past month and is now 56c/kg higher than a year ago, underscoring robust processor demand despite recent fluctuations.

These price movements reflect a market adjusting to the ongoing high supply levels and fluctuating seasonal conditions. The increased processing throughput in February likely contributed to the short-term pricing dips, particularly in Heavy Steer and Processor Cow categories. However, the longer-term upward trend in these indicators suggests resilience in demand, particularly from processors looking to secure supply amid uncertain seasonal conditions.

The latest price trends suggest that while short-term fluctuations are occurring, the overall trajectory remains relatively strong. Heavy Steer, Feeder Steer, and Processor Cow prices are all higher than this time last year, reinforcing continued market resilience. Local cattle producers will need to monitor seasonal developments closely, particularly in light of potential weather disruptions and market shifts. Given the early surge in processing bookings and seasonal uncertainties, strategic selling decisions will be crucial in optimising returns.

Overall, the Australian cattle market is navigating a dynamic period, with elevated yardings transitioning into stronger processing throughput across most states. While price fluctuations reflect short-term supply pressures, the broader outlook remains stable, underpinned by strong export demand particularly from the United States of America as they remain in a very tight beef supply situation. As 2025 progresses, industry participants will need to stay agile, leveraging market insights to adapt to evolving conditions and maximise opportunities.