Key Points

- The past fortnight has been a good reminder of how significant an impact the weather has on cattle markets in this country.

- Feedlots driving the market at present as some yards are caught short of cattle à expect this to continue in the short term and solid supplies of heavy feeders to be made available in Q1 2025 with these cattle held back at the end of 2024.

- Angus spread over flatbacks narrows to its tightest level in 12 months at 3c/kg lwt – there is potential in the next 3 weeks that we see Angus at a discount to flatbacks.

A little reminder

- As much as we like to think global factors play a really big role in the cattle markets here in Australia, this past fortnight has been a reminder that the weather still dominates and dictates market movements in this country for cattle prices.

- With stable weather 3 weeks ago, the market was stable, all of a sudden post general widespread falls in QLD in the past 2 weeks, the feeder market has kicked 20c/kg.

- The recent rain has seen feedlots drive the market, not producers, as some feeders are caught short on cattle, “space” bookings have disappeared as producers hold cattle to add weight, the reaction of good summer grass growth in QLD for the flatback cattle country are big reasons for this.

Supply

- November beef export estimates for the month between 118-126,000 tonnes.

- Puts Year to November exports (if realised) to be 45-55,000 tonnes ahead of the record years of 2014 and 2015 with one month to go.

- A lack of Victorian processor reporting of weekly cattle kill figures with the NLRS means VIC is actually processing around 40,000 head a week, not the 22,000 reported via NLRS.

- WA in the same situation, this means the industry is missing seeing nearly 22,000 cattle processed in the data (using last week) just between two states.

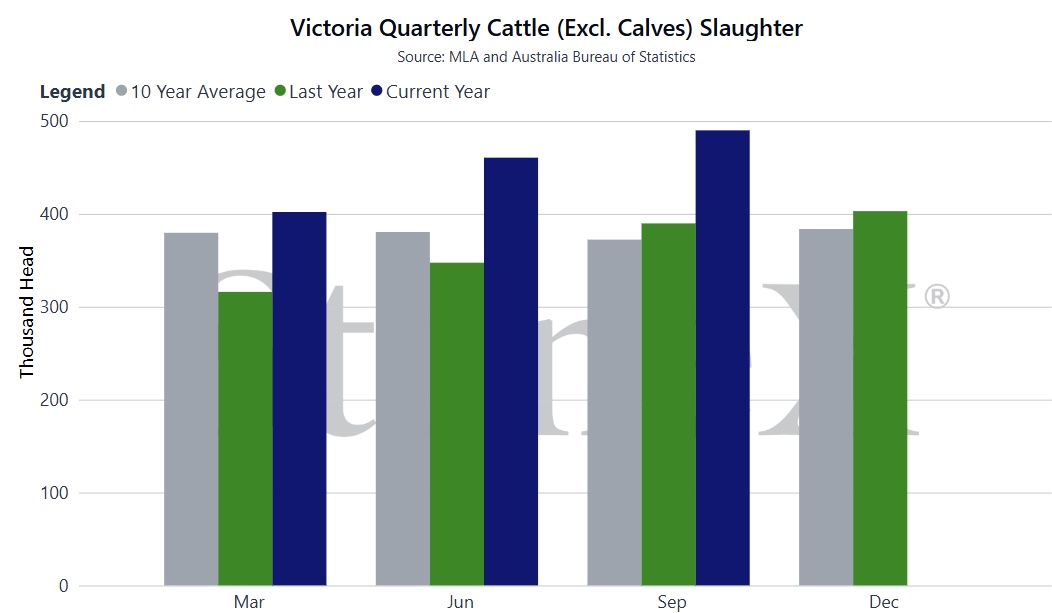

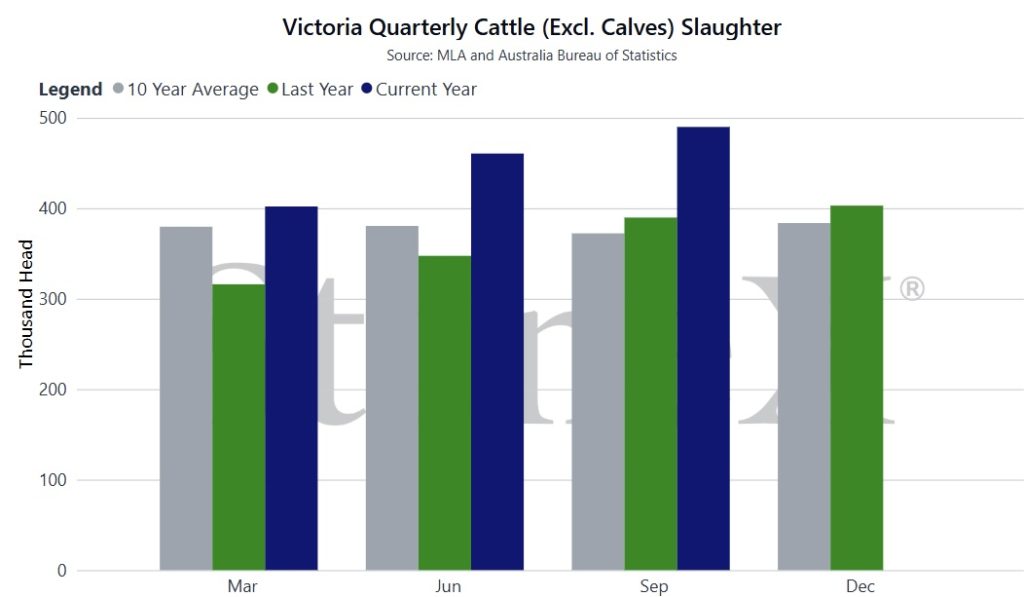

- As a side note, look at how strong Victorian cattle slaughter volumes are this year relative to last year and 10-year averages.

- This says a few things, #1 larger turnoff as producers sell cattle due to dry conditions, #2 the increase in VIC processing throughput YoY & #3 not directly but the numbers of cattle, particularly cows pulled into VIC to be killed this year, from the northern states (QLD, NT).

- Dalby had its biggest yarding in 12 months as QLD producers sell into a rising feeder market.

Demand

- The restockers are following the feedlot’s lead and buying cattle to be backgrounded over summer, particularly the Queenslanders.

- Spreads between restocker and feeder steers continues to widen.. affecting margin at the other end of the trade?

Price

- As expected, based on Argus, the spread of Angus over flatbacks has narrowed to its tightest level in 12 months at 3c/kg lwt. There’re examples in the paddock market of flatbacks having a premium over Angus due to the higher Angus supply.

- Considering the strength of the flatback market, there is potential that the Argus angus price in the near future operates at a discount to flatback cattle, the first time this has happened since the Argus Northern Angus price’ inception.

- The logic of economics is being defied in this market and I can’t seem to work out why? Strong supply yet the feeders are scrambling for cattle and prices are lifting.

- The comment of feedlots being full or spaced booked forwards on flatbacks 4-6 weeks (generally) looks not to be true on face value considering how hard feeders are going at the minute to access cattle.

- Furthermore, improving fed cattle margins with a softening grain market and lifts in OTH fed cattle prices at the other end is encouraging feedlots to source cattle as the space bookings dry up.

- With this rain in QLD at the minute setting up places with a body of summer grasses, holding cattle back over summer to weight – watch Q1 2025 when these cattle are sold, heavier weights are in order, you may see feeders look to compete more on lighter weights to protect margin.

- Backgrounder / trade buyers are stepping in buying cattle seeing the spot feeder prices lift and rain fall. The issue here is, what’s the feeder price going to be in late summer/Autumn when these cattle are sold? No one knows, which is why risk management is so important and locking away a margin on a portion of your cattle is critical as a seller.

Weather

- Pouring with rain here north of Roma in QLD at the minute, summer grasses starting to fire right across the Maranoa, east into the Downs, down to the border with NSW à expect another strong week of cattle prices next week due of this rain.

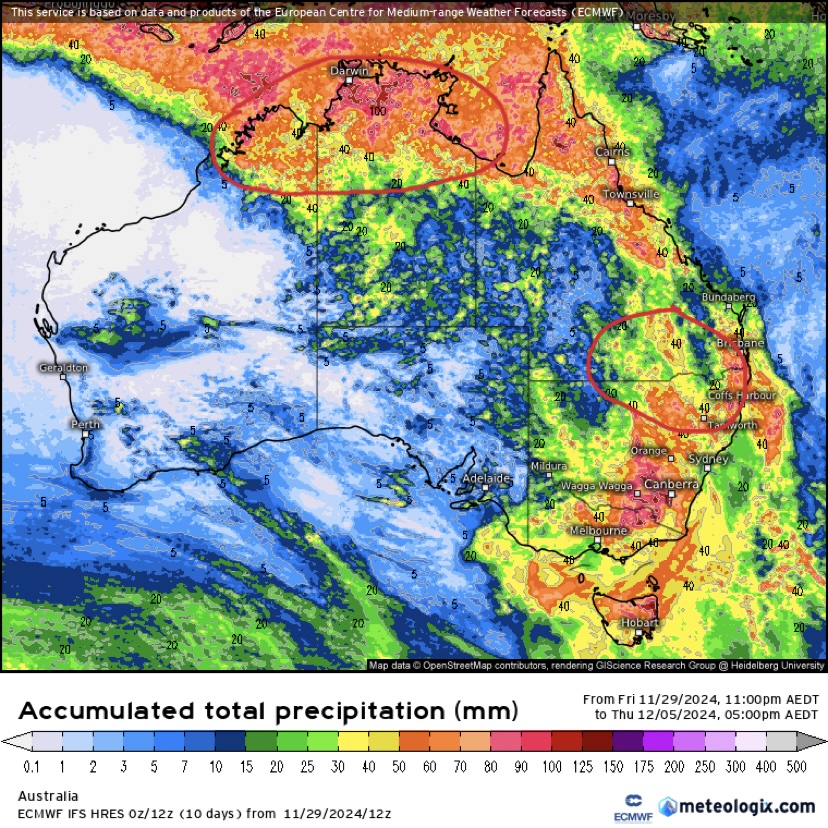

- ECMWF IFS 7 day accumulated precipitation forecast below – monsoonal storms beginning across the top end through the Kimberly across to the gulf, another 30+mm expected for northern NSW into QLD.

- Soil moisture already in the upper percentiles of long-term averages for major breeding regions; Cloncurry, the Barkly Tablelands and Victoria River District – setting these areas up for a strong start to the 2024/25 wet season.

Ripley Atkinson | Australian Livestock & Commodities Manager

M: +61 427 417 803

www.stonex.com | ripley.atkinson@stonex.com

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727)

Suite 28.01 | 264 George Street | Sydney | NSW | Australia

NASDAQ: SNEX

StoneX Disclaimer

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business.

StoneX Financial Pty Ltd (ACN 141 774 727) holds an Australian Financial Service License (AFSL: 345646) for Dealing in Securities, Exchange-Traded Derivatives Contracts, OTC Derivatives Contracts and Foreign Exchange Contracts, and is regulated by the Australian Securities and Investments Commission.

‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.