Sheep Processor Trading Conditions Model

Regular readers will know that we report monthly on beef processor trading conditions via the use of a theoretical model developed by the team at Episode 3. Over the Christmas break we have constructed a similar model in order to track sheep processing trading conditions in Australia.

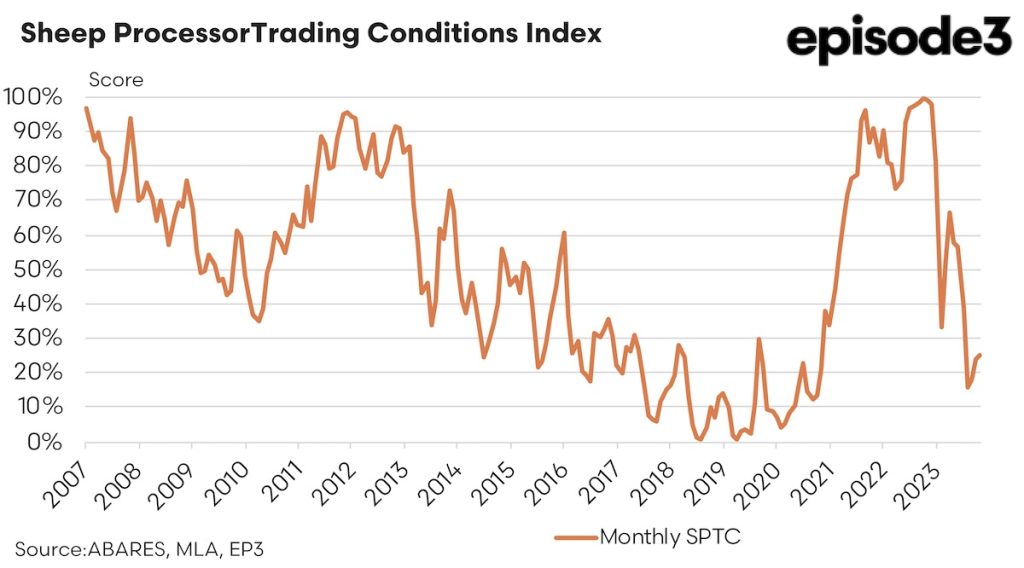

The Sheep Processor Trading Conditions (SPTC) Index provides a unique and innovative tool for understanding the performance and trading conditions of Australian sheep meat processors. Designed to function like a rain gauge, the model ranks processor trading conditions on a scale from 0% to 100%, reflecting percentile rankings compared to historical data. A higher score indicates more favourable conditions, making the SPTC Index an intuitive and valuable benchmark for assessing processor performance over time. A score of 90% indicates that the current sheep processor trading conditions are better than 90% of the historic conditions going back to 2007, a bit like a decile 9 on a rainfall chart highlighting much wetter than average conditions.

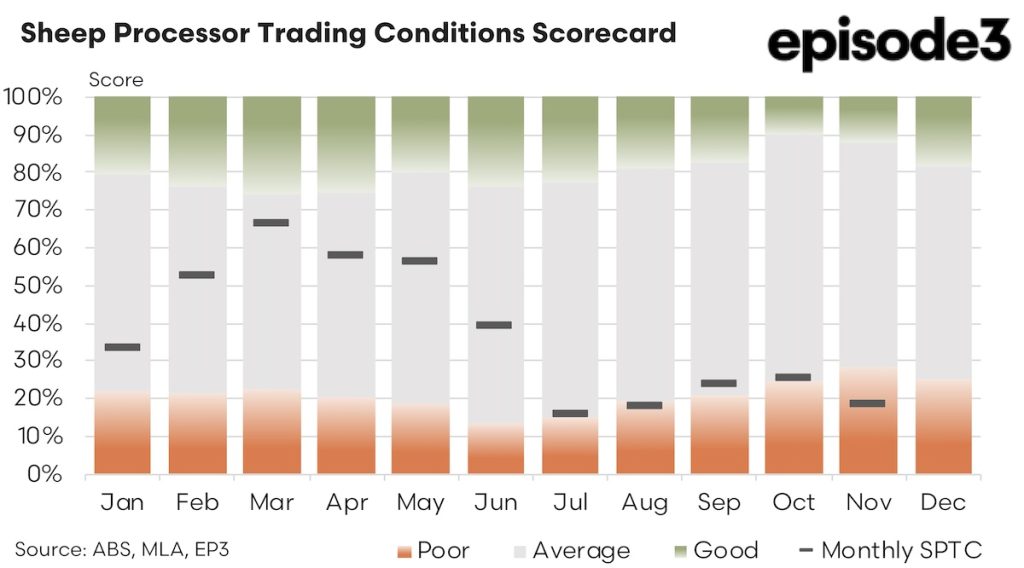

In 2024, the SPTC Index demonstrated considerable variability, capturing the challenges and shifts faced by processors throughout the year. The year began on a positive note, with the first quarter showing a promising improvement in conditions. This upward trajectory continued into the second quarter, which recorded slightly above-average results, signalling relative stability for the industry. However, by mid-year, conditions became notably tougher, with several factors combining to strain processor margins and disrupt earlier gains.

Between the second and third quarters of 2024, a range of market dynamics emerged that tightened processor profitability. One of the most significant developments was the 10-20% increase in sheep and lamb prices paid by processors. While higher livestock costs often signal strong demand, they simultaneously erode processor profitability unless offset by equivalent gains in export or domestic pricing.

Export performance during this period presented a mixed picture. Chinese export prices for Australian sheep meat rose sharply, averaging a 23% increase and providing a much-needed boost. However, performance in other critical export markets was less encouraging. For instance, export pricing to Malaysia remained flat, the Unite Arab Emirates (UAE) recorded only a modest 8% increase, and the U.S. market experienced a 9% decline. These uneven results placed additional pressure on processors, as the gains from the Chinese market alone were insufficient to compensate for weaker outcomes elsewhere.

On the domestic front, lamb retail prices increased by 10%, helping to alleviate some of the rising costs associated with livestock purchases. Despite this improvement, the additional revenue generated from higher retail prices did not fully offset broader cost pressures. Co-product sales, a vital revenue stream for processors, rose by only 7% during the quarter, falling short of the increase in livestock costs. Adding to these challenges were rising manufacturing expenses. Costs associated with wages and utilities increased by approximately 2% during the quarter, further compressing processor margins. These factors combined to make the third quarter of 2024 particularly challenging for sheep meat processors.

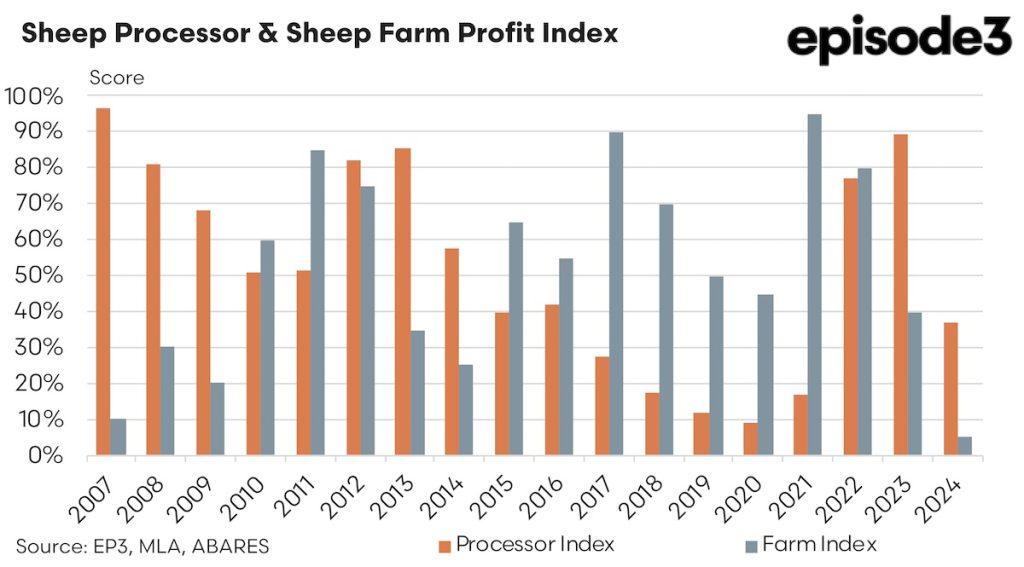

When reviewing the long-term trends highlighted by the SPTC Index, an intriguing counter-cyclical relationship with the ABARES sheep farm profit index becomes apparent. Over the years, the data reveal that when processors perform well, sheep farmers often face tougher conditions, and vice versa. For example, in 2007, the SPTC Index stood at an exceptionally strong 97%, indicating highly favourable conditions for processors, while the sheep farm profit index was a mere 10%.

Similarly, in 2023, processors recorded a strong SPTC Index of 90%, yet sheep farm profitability reached only 40%. Conversely, during periods of high sheep farm profitability, such as 2011 and 2021, when the farm profit index stood at 85% and 95% respectively, the SPTC Index recorded relatively weak scores of 51% and 17%. This inverse relationship underscores the delicate balance in the supply chain, where the prosperity of one segment often comes at the expense of the other.

In 2024, this counter-cyclical dynamic persisted, albeit under particularly challenging conditions for both processors and farmers. The SPTC Index fell to 37%, reflecting significant headwinds for processors. Meanwhile, the sheep farm profit index plummeted to just 5%, one of the lowest levels in recent history and likely compounded by weak wool receipts. This simultaneous decline for both groups underscores the profound difficulties facing the broader industry, where rising input costs, uneven global demand, and constrained margins are creating significant pressures throughout the supply chain.

The SPTC Index provides helpful insights into the sheep meat industry, offering stakeholders a clear framework to assess challenges and opportunities. By regular assessment and reporting, the index can help the supply chain navigate market complexities and supports sustainable, shared prosperity in a dynamic environment.