Market Morsel

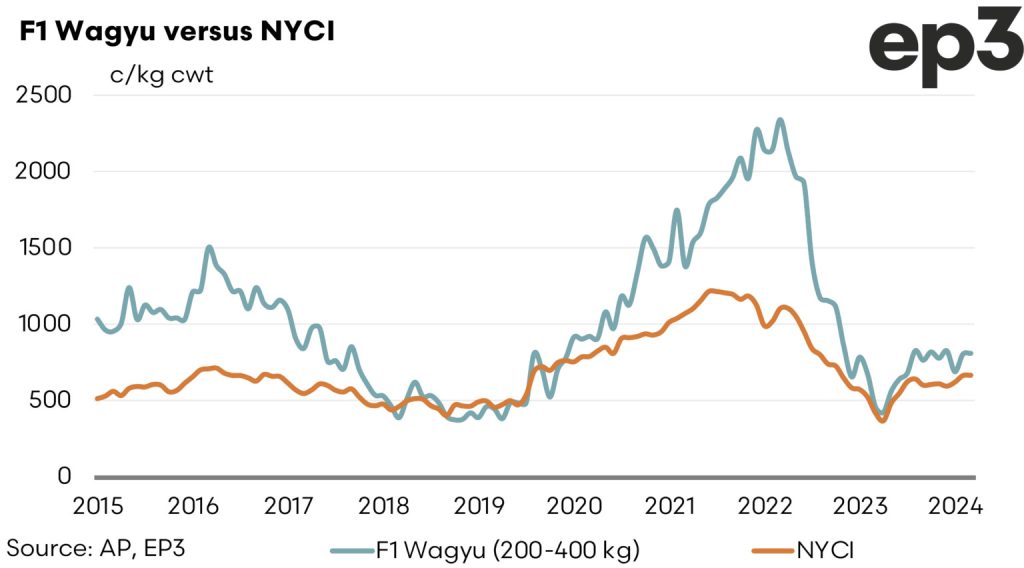

This article provides an analysis of the current F1 Wagyu cattle prices in Australia for heifers and steers, that weigh between 200-400kg live weight, sold on the AuctionsPlus platform. As a reference point to the broader Australian cattle sector, the analysis compares F1 Wagyu pricing to the National Young Cattle Indicator (NYCI).

During June/July 2024, the market has witnessed a notable decline in prices for F1 Wagyu cattle, with average monthly prices varying significantly, dropping from 835c/kg to 695c/kg on a carcass weight (cwt) basis. This mid-year softening of prices has been linked to a broader availability of F1 Wagyu cattle and evolving market expectations, which have been influenced by several larger supply chains and their inventory management strategies.

Additionally, the dynamics within feedlots are changing; some feedlots are shifting their focus away from Wagyu towards Angus and other feeder breeds due to the challenging nature of the Wagyu export meat market. These include pessimistic seasonal outlooks and weaker economic conditions in key export markets such as China, Japan, and Korea, which have dampened their demand for high-quality Wagyu meat.

Anecdotal reports indicate that one large commercial yard has reduced its Wagyu inventory from 45% to 30%, indicative of a broader trend where feedlots are adapting to market pressures by diversifying their livestock.

The influx of F1 Wagyu into the market has also increased, with feedlots reporting a surge in offers from breeders, including many who are new to F1 Wagyu breeding or those previously affiliated with other Wagyu supply chains but are now exploring better opportunities due to current uncertainties in the market. This rise in supply is met with a complex vendor landscape where previous price signals, considered somewhat inflated, have caused discontent among vendors, reflecting a misalignment with the actual market level.

August/September saw a mild recovery in the broader Australian cattle market with the NYCI lifting by nearly 8% and this support carried through to F1 Wagyu pricing with average monthly prices increasing from around 700-730c/kg cwt in early August towards 820 cents as at the end of September 2024.

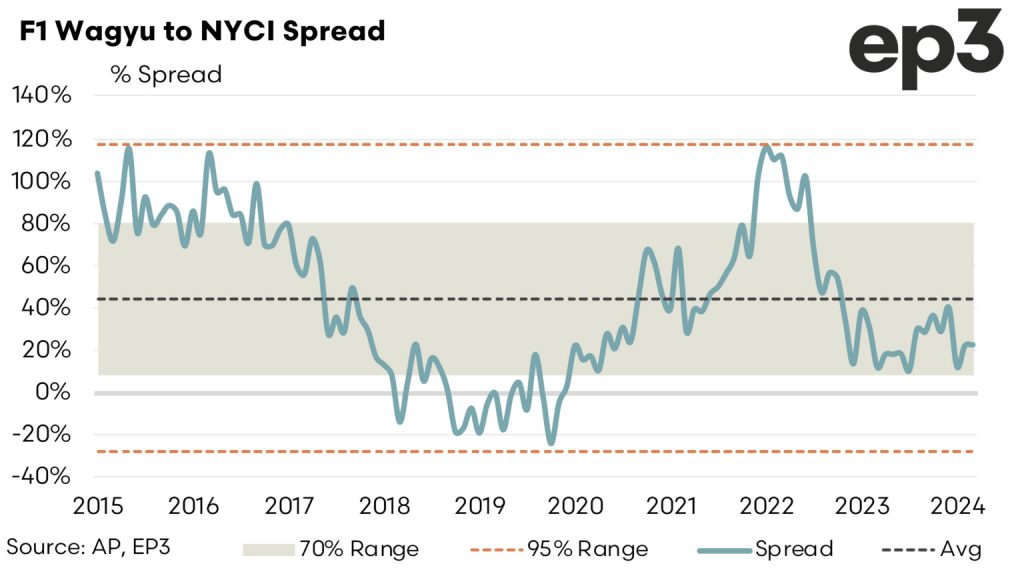

Analysis of the percentage price spread of F1 Wagyu to the NYCI highlights that although the Wagyu premium has improved in the last few months it still remains below the historic long term average level of around a 45% premium.

The mid-year dip in F1 Wagyu prices saw the premium spread drop to the lower boundary of the “normal” range. As the 70% range highlights F1 Wagyu pricing, when compared to the NYCI, usually fluctuates between a 10% to 80% premium and in July 2024 the premium dipped to 12% before recovering to a 23% premium as at the end of September.

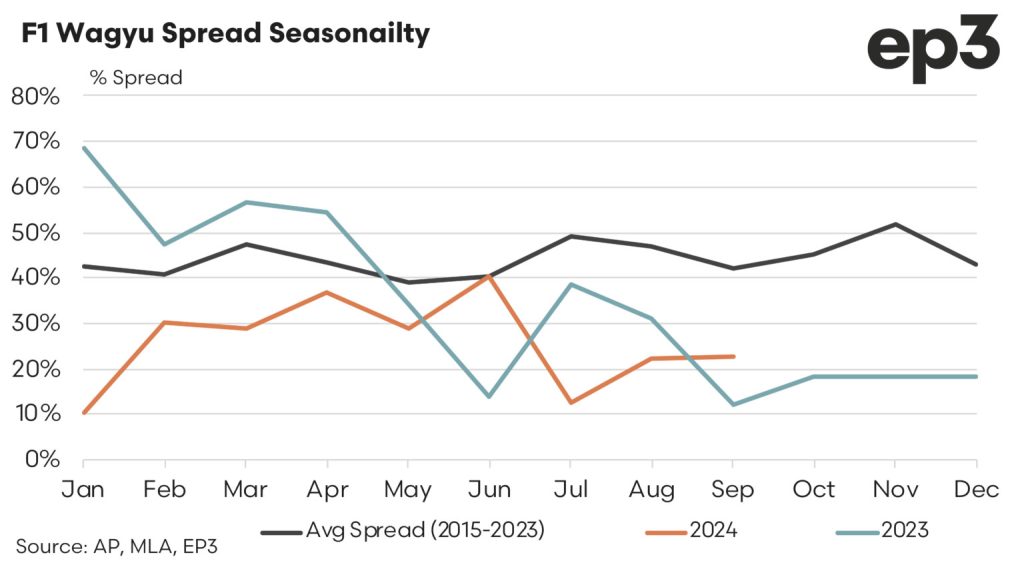

Indeed, as the seasonality chart demonstrates below the F1 Wagyu spread has tested the lower boundary of the 70% range at around 10% twice in 2024, during January and July, and twice in 2023, during June and September, before staging an improvement. The January 2024 and June 2023 improvement saw the spread recover towards 40% premium each time, however the September 2023 recovery in spread levels only managed to climb back to a 20% premium. Time will tell if the recent dip in spread in July 2024 will manage to test back closer to the long term average levels between 40%-50%.