Key Points

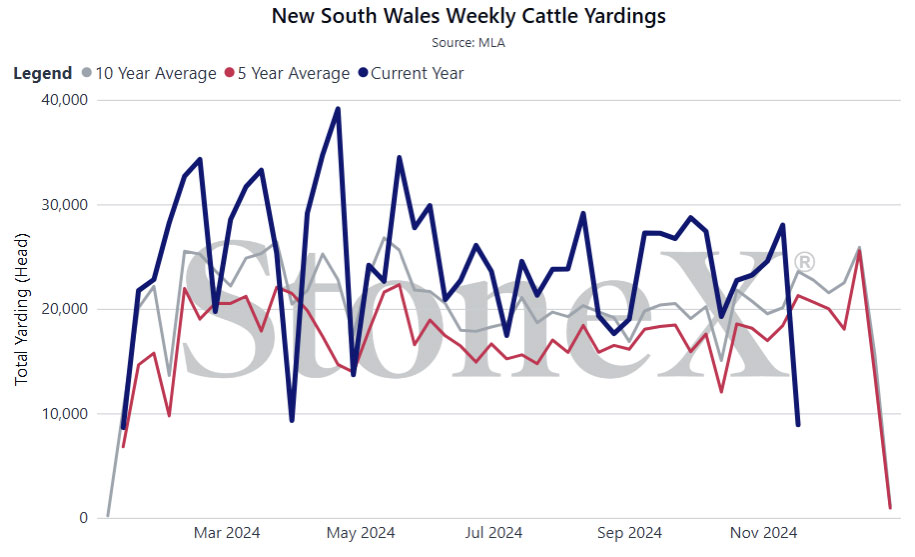

- Saleyard cattle supply in NSW running nearly 40% above 10-year averages, telling you how strong the numbers are in NSW at the minute.

- What happens in 25’ if and when the US enters a rebuild but in Australia, producers aren’t pushing the market, how significant is the upside?

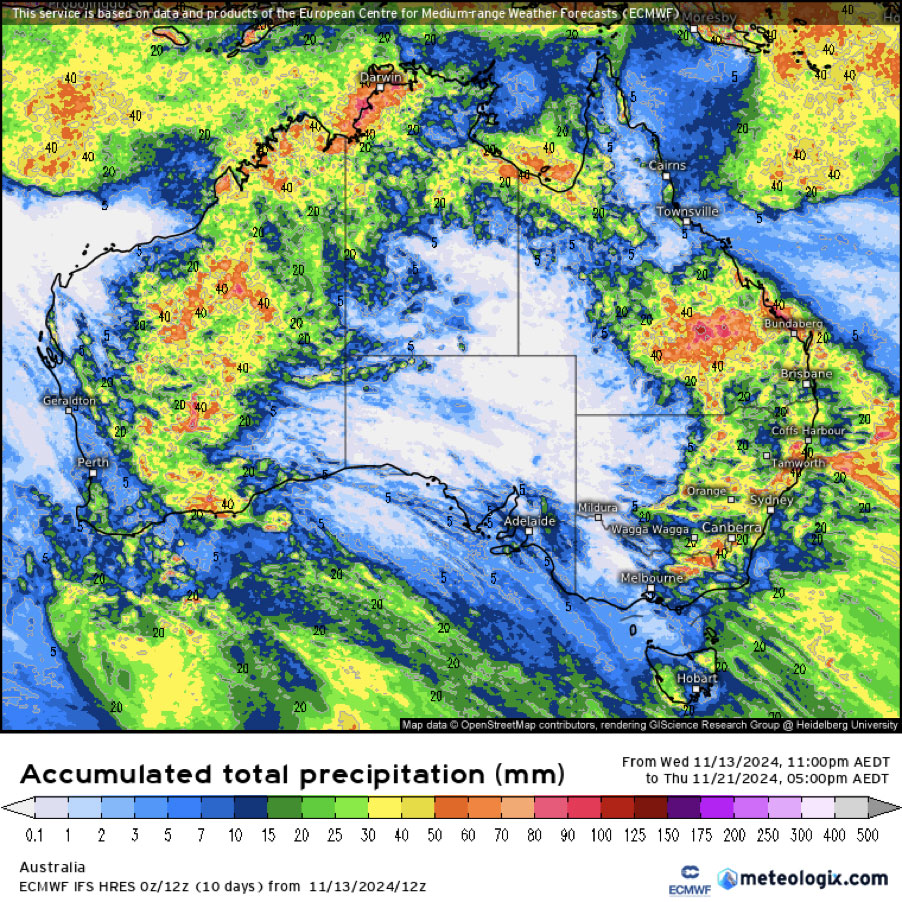

- Rain for southern and central QLD next week should see the market have another week of firm prices.

Tale of two halves

- The market was a tale of two halves this week, with the north seeing stronger prices whilst the south, dealing with a season that’s cutting out, is showing signs of pressure. Secondary quality cattle continue to cop it, quality pays.

Supply

- In the yards, most centres saw supply rise further, particularly the south à others were unchanged and some QLD centres post rain earlier in the week tightened up.

- Cattle saleyard supply in NSW for week ending Friday 08th November was 52% higher than the 5-year average for the same week and 39% higher than the 10-year average.

- Its an interesting statistic that shows you how strong the herd is here in NSW at the minute, with numbers as per the chart below, operating well above long term historical performance for most of the year.

- Slaughter only softened 3k head to 140k last week despite VIC shutdowns due to Melbourne cup à the processors now have a clear run until Christmas for the last 6 weeks of 24’.

- YTD NLRS slaughter in 2024 is 16,400 head stronger on average per week than YTD 23’ volumes. There will be a significant slowing in 2025 on weekly increases but it should remain none the less.

- Seemingly rain has done little to dampen saleyard supply this week, although with further falls for northern NSW & southern and central/western QLD over the next week, tighter numbers next week shouldn’t be a surprise.

Demand

- Feeding margins on 100 day cattle is assisting how stable prices have been over the past few month, the larger general feedlot capacity is also aiding the lot feeding sector’s capacity to handle these numbers – something 3-5 years ago would have been less realistic.

- How does 2025 pan out if #1 the US does in fact enter a rebuild at some stage and #2 demand from the producer end of the market remains subdued? Will it really push cattle prices significantly higher?

- Feedlots and processors will want to protect margin where they can so without higher demand from producers to push the market along at this point in the cattle cycle how significant is the upside and why will it lift?

- QLD feeders starting to make their way south as supply runs short of crossbred flatbacks with musters ending out of the north and west in QLD – keep an eye on this over the next few weeks, it may have the capacity to hold prices a little if firmer if weather holds numbers back.

Prices

- Firm to a touch dearer this week, tighter supplies of feeders in QLD has seen provided some support further south for these cattle as buyers go searching.

- Angus spread with flatbacks continues to come under pressure, this will be the case into early 2025, with supplies of Angus cattle remaining robust – particularly out of northern NSW.

- Heavy steers are having a good run, up 10c over the month.

- Mixed bag on a state basis though as mentioned earlier in this email, the south softer and north definitely reacting to supply adjustments and the rain.

Weather

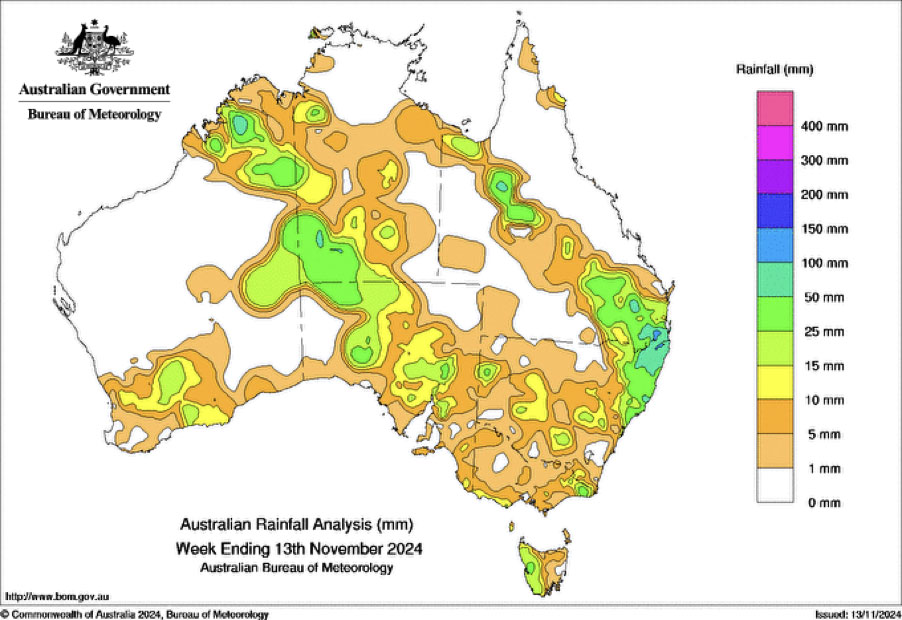

- The Victorian / South Australian rain will have done very little to assist those operators, with the season now cutting out, particularly following some hot weather and wind recently. Further falls for the north – some good rain forecast for the north in DEC which will be important to watch.

- You can see the rain through Southern QLD around the downs will have definitely tipped the market that bit higher due to tighter supplies, good falls which were needed!

- Looking ahead – another system coming through late this week should further support another week of firmer prices. ECMWF 7 day total precip forecast below:

- Good rains through CQ will be appreciated, if this eventuates expect the major saleyard centres of Roma and Dalby to find some good support next week.

Ripley Atkinson | Australian Livestock & Commodities Manager

M: +61 427 417 803

www.stonex.com | ripley.atkinson@stonex.com

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727)

Suite 28.01 | 264 George Street | Sydney | NSW | Australia

NASDAQ: SNEX

StoneX Disclaimer

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business.

StoneX Financial Pty Ltd (ACN 141 774 727) holds an Australian Financial Service License (AFSL: 345646) for Dealing in Securities, Exchange-Traded Derivatives Contracts, OTC Derivatives Contracts and Foreign Exchange Contracts, and is regulated by the Australian Securities and Investments Commission.

‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.