Key Points

- Producer cautiousness continues to permeate throughout the cattle industry due to challenged financial positions and a reluctance to trade and utilise excellent spring conditions a result of the 2023 hangover.

- Q3 Cattle slaughter estimated range to reach 2.14-2.17 million head, the highest level in 5 years with beef production estimates at 650,000 tonnes plus, highest since Q4 2014.

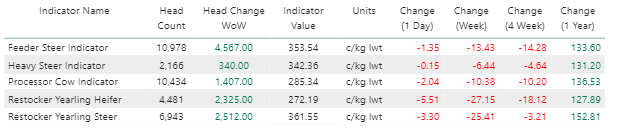

- Cattle markets ended the week in the red across the board for the first time since late June – a product of higher supply placing solid downward pressure on price.

Cautiousness

- At times throughout this year, I’ve continually made the point about producer cautiousness and the impact this may have on their capacity to fully utilise and appreciate the ideal trading/spring fattening conditions on offer.

- Conversations last week with a number of others and a producer client who has seen a fair bit of eastern Australia recently indicated exactly that, producers don’t want to step into the market because they’re stretched financially and can’t make use of the grass on offer.

- Australian Community Media National beef reporter Shan Goodwin wrote an article last week explaining the exact same issue her contacts are communicating to her. Interest rates, repayments, cautiousness and the hangover of 2023 is all impacting willingness to step into the market meaning a missed opportunity for optimal trading conditions, both in the market and the paddock. An excerpt from the article by Shan below:

- “A hangover of panic, stemming from the drastic drop in prices this time last year, and a lack of faith in weather forecasting, is making producers gun-shy about taking on more stock, especially where it requires additional debt, agents and consultants are reporting” – “Cattle Bucks go begging while gun-shy producers stand in knee deep grass”, written by Shan Goodwin 20/09/2024

- That producer cautiousness 12 months on, hasn’t gone away from last year and it demonstrates behavioural economics at play. The outlook and fundamentals of Australia’s beef industry are positive on a number of fronts, but when emotion is brought into markets (typically in relation to producer sentiment + media and industry discussion on weather), this will ensure volatility in cattle prices will rear its ugly head again when the time comes.

US Heifers on Feed

- New data comes out within the next month for the September quarter in the US but the below chart from the MyStoneX platform illustrates the heavy contribution heifers are still making to total numbers on feed in the US. Relative to the bottom of the previous rebuild cycle in 2014/15 & longer term quarterly historical performance.

- In Q1 2015, heifer placements accounted for 31% of total numbers on feed, in Q2 2024, heifers accounted for 39.65% of cattle on feed, near historical highs.

- This tells you, there’s little appetite from US ranchers to retain heifers on farm to rebuild numbers as they continue to push heifers into feedyards.

Supply

- Beef exports for September estimates at 110-118,000 mt when figures are released next week.

- Q3 2024 cattle slaughter on track to surpass Q2 numbers, estimated to be 2.14 – 2.17 million head, this would represent the highest quarterly kill in 5 years.

- Beef Production estimates for Q3 to be above 650,000 tonnes, making it the second highest production quarter on record if this is realised and the highest since Q4 2014.

- Saleyard supply this week showed their first signs of properly kicking into gear, although based on the rain forecast and falling currently, this may be shortlived.

- Dubbo today had its largest prime market yarding since April 2018 at a touch over 7,100 head.

- Total national prime market numbers were at their highest since April this week.

- Generally there’s plenty of cattle moving at present, this is reflected in a softening of grid prices and the broader market. Angus numbers are starting to flow, as is seasonally expected.

- Looking ahead àit may be a case of “saved by the rain”, supply should tighten in reaction to this system at the minute, grid and OTH prices may react accordingly if feeders and processors are found short as producers hold stock back or can’t access paddocks/roads.

- That supply reduction next week may be delayed as transport road access and access to paddocks is put on hold. Meaning the next fortnight could see tighter numbers until clear weather sorts out accesibility.

Demand

- Slaughter cattle demand is softening from processors, with the US grilling season over, and some pushback from the imported market on price.

- Higher supply is helping to place pressure on grids and prices, hiccups in supply due to rainfall may see prices react although if weaker US demand for CL trim continues which from our StoneX US team suggest itwill, this may affect overall processor appetite for paying up moving forwards.

- If the theme of cautiousness continues to be present, has the ceiling been found for cattle back to the paddock due to the aforementioned reasons?

- Quality was a big theme this week in the saleyard markets, the well bred and presented lines with weight are firm. Secondary and plainer types bore the brunt of the softer demand.

Price

- The week has ended with red across the board. The first time this has been seen since late June before the market kicked.

- Supply pressure and a mixed bag on the quality front pushed prices down this week

- Feeder availability in QLD & Northern NSW continues to pressure prices, reflected in softer grids, particularly on the Angus programs.

- The Angus to flatback spread should continue to narrow as higher supplies of Angus come forward.

Weather

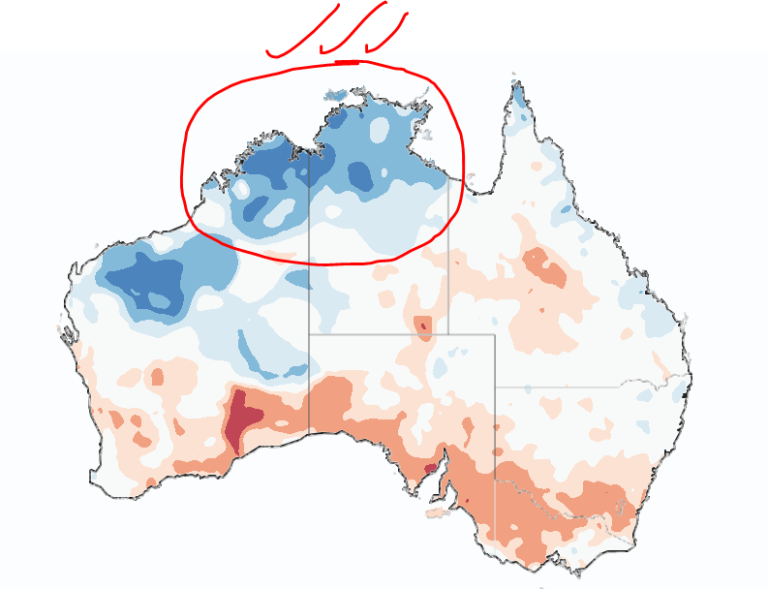

- The below chart (albeit generalised) from the BOM, shows root zone soil moisture, top end of the Barkly, Victoria River District and the Kimberly shows excellent soil moisture for this time of year. The areas are home to big breeding herds, and the maps give an indication that if an average wet eventuates for the north, aided by ample soil moisture, would set them up for their herds to continue to grow in 2025 with good grazing conditions and improved fertility from a more productive female base.

- The front/s that have moved across the north west into central Australia over the past week have brought rain unseen for these areas in nearly 40 years.

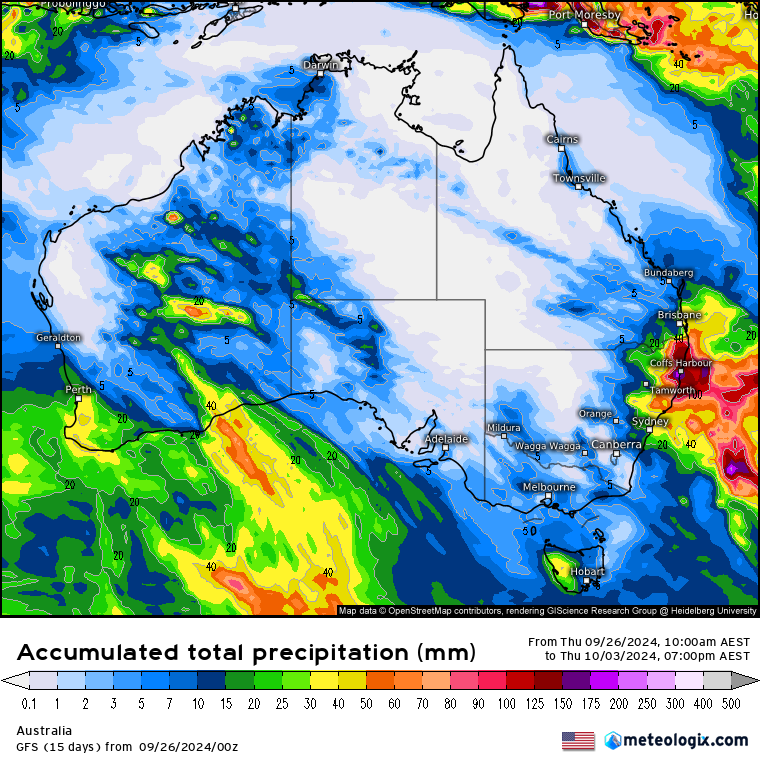

- GFS 7 day forecast below – along the Divide, north of sydney in for solid falls in the next week. Further potential via other forecasts for more widespread rain.

Ripley Atkinson | Australian Livestock & Commodities Manager

M: +61 427 417 803

www.stonex.com | ripley.atkinson@stonex.com

StoneX Financial Pty Ltd (ACN 141 774 727 | ABN 50 141 774 727)

Suite 28.01 | 264 George Street | Sydney | NSW | Australia

NASDAQ: SNEX

StoneX Disclaimer

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business.

StoneX Financial Pty Ltd (ACN 141 774 727) holds an Australian Financial Service License (AFSL: 345646) for Dealing in Securities, Exchange-Traded Derivatives Contracts, OTC Derivatives Contracts and Foreign Exchange Contracts, and is regulated by the Australian Securities and Investments Commission.

‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.